![]() Irish Fiscal Advisory Council Strategic Plan 2017–2019

Irish Fiscal Advisory Council Strategic Plan 2017–2019

Introduction

The Fiscal Responsibility Act 2012 established the Irish Fiscal Advisory Council (“the Council”) as an independent state body. This, our second Strategic Plan, is about looking forward. It sets out our mission, vision, values, and goals. It presents our three-year plan to strengthen our role in assessing macroeconomic and budgetary forecasts, monitoring compliance with Irish and EU fiscal rules, and advising on fiscal policy. It also describes how we plan to further develop our capacity in relation to each element of our mandate.

Strengthening Ireland’s fiscal framework is an important, positive legacy of the economic crisis and one which the Government has committed to respecting. Successive governments have achieved significant progress in resolving the crisis. Ireland saw its deficit fall below 3 per cent in 2015, and so graduated from the Corrective Arm of the EU’s Stability and Growth Pact. As a result, the Preventive Arm of the EU’s Stability and Growth Pact—as well as the domestic Budgetary Rule—applied to Ireland in 2016. However, the Government’s medium-term fiscal strategy of “balancing the books” faces new challenges, such as the post-exit economic relationship between Ireland and the UK. The fiscal rules can help prevent governments repeating policy mistakes that contributed to economic crises in recent decades.

An independent fiscal “watchdog” can be a key component of a country’s fiscal architecture. The Council will prioritise delivering on each element of our mandate as set out in the Fiscal Responsibility Acts 2012 and 2013, to support sustainable economic growth. I feel confident that the Council and its Secretariat will ensure that we fulfil our important role.

Seamus Coffey

Chairperson

Mission

The Council’s mission is to support the effectiveness of fiscal policy in the near- and medium-term through delivery on each element of its mandate as an independent fiscal institution.

Vision

The Council’s vision is for an economy with broadly based growth in incomes and employment founded on sustainable macroeconomic and fiscal policies.

Values

The key values of the Council are:

- High quality analytical output.

- Independence and integrity.

- Openness, objectivity and transparency.

- Highest ethical standards.

Background

Mandate of the Council

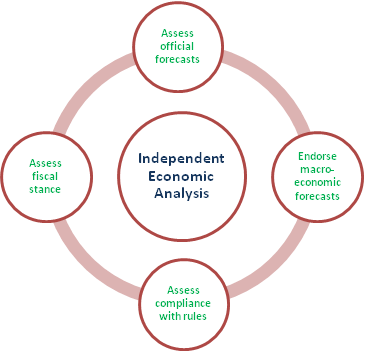

The Council has four legally mandated functions. The first three were assigned in the Fiscal Responsibility Act 2012 [1]. The fourth function (endorsement) was assigned to the Council in July 2013 [2].

- To assess the official forecasts produced by the Department of Finance and published in the Stability Programme and in the Budget.

- To assess the fiscal stance of Government, and specifically whether it is conducive to prudent economic and budgetary management, with reference to the EU Stability and Growth Pact.

- To monitor and assess compliance with the Budgetary Rule [3].

- To endorse the official macroeconomic forecasts prepared by the Department of Finance in relation to each Budget and Stability Programme. This follows revised European requirements to have national medium-term fiscal plans and draft budgets based on independent macroeconomic forecasts, which means macroeconomic forecasts produced or endorsed by an independent body. A joint Memorandum of Understanding between the Council and the Department of Finance underpins the endorsement process [4].

The Council produces biannual Fiscal Assessment Reports, as well as an annual Pre-Budget Statement. Reports are submitted to the Minister for Finance and subsequently published within ten days. The Council lays its Annual Reports before each House of the Oireachtas. The Council chairperson may also be required to appear before the Oireachtas in relation to its activities.

In relation to the endorsement function, the Council is required to provide a formal letter to the Secretary General of the Department of Finance at least five working days before the Department publishes the Budget and Stability Programme [5]. If the Council were to conclude that it had significant reservations about the preliminary or “provisional final” macroeconomic forecasts, it would immediately communicate these informally to the Department. If, following further discussions, the Council were still not in a position to endorse the macroeconomic forecasts underlying the Budget or SPU, the Chair would write to the Secretary General explaining why this was the case, at least five working days before the Department publishes the Budget or SPU.

To support the Council’s delivery of its mandate, the Council also produces ad hoc reports including Analytical Notes, Working Papers and other analytical work on the Irish economy, macroeconomic forecasting, and fiscal policy, in addition to an annual Ex-Post Assessment of Compliance with the Domestic Budgetary Rule (the first of which is to be published in 2017).

Current Position of the Council and Progress to Date

The Minister for Finance appointed the Council’s five members based on their experience and competence in domestic and international macroeconomic and fiscal matters. The current Council has a strong international dimension with three members based outside of Ireland.

The Secretariat’s full complement of staff is a Chief Economist, two Economists, two Research Assistants, and an Administrator.

To date, the Council has published:

12 Fiscal Assessment Reports

- October 2011

- April 2012

- September 2012

- April 2013

- November 2013

- June 2014

- November 2014

- June 2015

- November 2015

- June 2016

- November 2016

- June 2017

3 Pre-Budget Statements

- Budget 2015

- Budget 2016

- Budget 2017

8 Endorsement Letters

- October 2013

- April 2014

- October 2014

- March 2015

- October 2015

- April 2016

- October 2016

- April 2017

1 Ex-Post Assessment of Compliance with the Domestic Budgetary Rule

- 2016

10 Analytical Notes

- “House Price Risks”

- “Sensitivity Analysis of the Department of Finance Approach to Potential Output Estimation under the EC Methodology”

- “Tax Forecasting Error Decomposition”

- “DIRT Forecast Methodology”

- “Future Implications of the Debt Rule”

- “Adoption of New International Standards for National Accounts and Balance of Payments”

- “The EU Expenditure Benchmark: Operational Issues for Ireland in 2016”

- “Controlling the Health Budget: Annual Budget Implementation in the Public Health Area”

- “Public Capital: Investment Stocks and Depreciation”

- “Challenges Forecasting Irish Corporation Tax”

4 Working Papers

- “Strengthening Ireland’s Fiscal Institutions” (January 2012)

- “The Government’s Balance Sheet after the Crisis: A Comprehensive Perspective” (September 2013)

- “Uncertainty in Macroeconomic Data: The Case of Ireland” (March 2015)

- “An Analysis of Tax Forecasting Errors in Ireland” (September 2015)

1 Independent Review of the Irish Fiscal Advisory Council

- June 2015

Key Challenges, Risks and Opportunities in our Operating Environment

Key Challenges

- Visibility: The Council needs to ensure awareness of its mandate and assessments, which cover key government decisions, in a crowded field of public debate, while ensuring that credibility is maintained.

- Administrative burden: Achieving all elements of mandate and expanding on Council’s analytical output is a challenge, given the small size of the Secretariat. Progress in relation to the development of more robust analysis of long-term fiscal projections and of fiscal risks is a resource-intensive process.

- Data/informational asymmetries: Government departments may have an informational advantage.

- Difficulties with interpretation of Irish national accounts: Difficulties with the interpretation of Irish national accounts, and the link between measures and rules, could prove to be a challenge.

Risks

- Capacity: Small size and defined resources (linked to Harmonised Index of Consumer Prices) mean ability to respond to changing circumstances or new analytical requirements may be constrained.

- Small size of Secretariat: Council is at risk if staff were to suddenly leave or to take periods of extended absence as there is limited scope for duplication of skill sets resulting in reliance on key personnel.

- Impact: Changing economic fortunes, political changes, or developments in the EU and Irish institutional framework could limit the ability of the Council to contribute to prudent and sustainable fiscal policy.

- Independence: Although the Council’s independence is underpinned by legislation, there could be moves to reduce current protections in the future.

- Cooperation: The Council is highly reliant on information from government departments and agencies, which is provided by goodwill rather than formal information-sharing arrangements. If this goodwill were to diminish, access to information could become more constrained.

- Organisational risks: Disruption to existing service-level agreements could severely impede the functioning of the Council.

- Timing: The current division between the Stability Programme Update and Summer Economic Statement poses a risk to the relevance of the Council’s work.

Opportunities

- Entering the Preventive Arm of the Stability and Growth Pact: Following Ireland’s exit from the EU-IMF programme of financial support on 15th of December 2013 and its achievement of a deficit below 3 per cent of GDP in 2015, it has now entered into the Preventive Arm of the Stability and Growth Pact. This has given more importance to new budgetary framework comprising greater surveillance (including that of the Fiscal Council) and a system of domestic and EU fiscal rules.

- Deeper analysis/research: A larger Secretariat gives scope for richer analysis, for making output more visible to relevant public bodies and the general public, for continuing to build the Fiscal Council’s reputation, and for developing long-term analysis of the public finances.

- European and domestic agenda: The Council could have a greater role in the European and domestic debate on fiscal rules, structures, and economic governance.

Strategic Goals

Central Goal: Deliver on all Elements of our Mandate

| Goal | Outputs |

|---|---|

Assessment of:

|

The Council will:

|

| Endorsement of Macroeconomic Forecasts. |

|

Supporting Goal 1: Ensure Compliance with all Requirements for a Statutory Body

| Goal | Outputs |

|---|---|

| Publication of Annual report and a set of financial accounts. | The Council will:

|

| Independence and transparency. |

|

| External review of Council operations. |

|

Supporting Goal 2: Promote Awareness of Fiscal Policy issues

| Goal | Outputs |

|---|---|

| Two Fiscal Assessment Reports and a Pre-Budget Statement every year |

|

| Analytical Notes and Working Papers |

|

| External communications and awareness of the Council |

|

Achieving Our Goals

| Goal | Outputs |

|---|---|

Economic Forecasting:

|

|

| Public Finances and Fiscal Rules. |

|

| Full-time six-person Secretariat. |

|

| Stakeholders. |

|