14 August 2025 – Beyond the Budget Blog Series

The Irish economy has experienced rapid growth in recent years. This is evident from rising employment levels, net inward migration, and population growth. All of these factors point to an increasing demand for infrastructure.

Why does infrastructure matter?

Households, businesses, and the government all rely on large-scale infrastructure. Businesses rely on roads, bridges, and ports to move goods efficiently. They need reliable electricity and internet access to produce and deliver their products and services.

Households depend on essential utilities like water and electricity for daily living, as well as roads and public transportation to get around. Meanwhile, critical government services—such as hospitals—require consistent access to electricity and water to operate safely and effectively.

Infrastructure plays a critical role in economic competitiveness. Ireland’s economy is heavily dependent on foreign multinational companies, and infrastructure is a key factor in their decisions about where to locate their operations.

Where does Ireland stand?

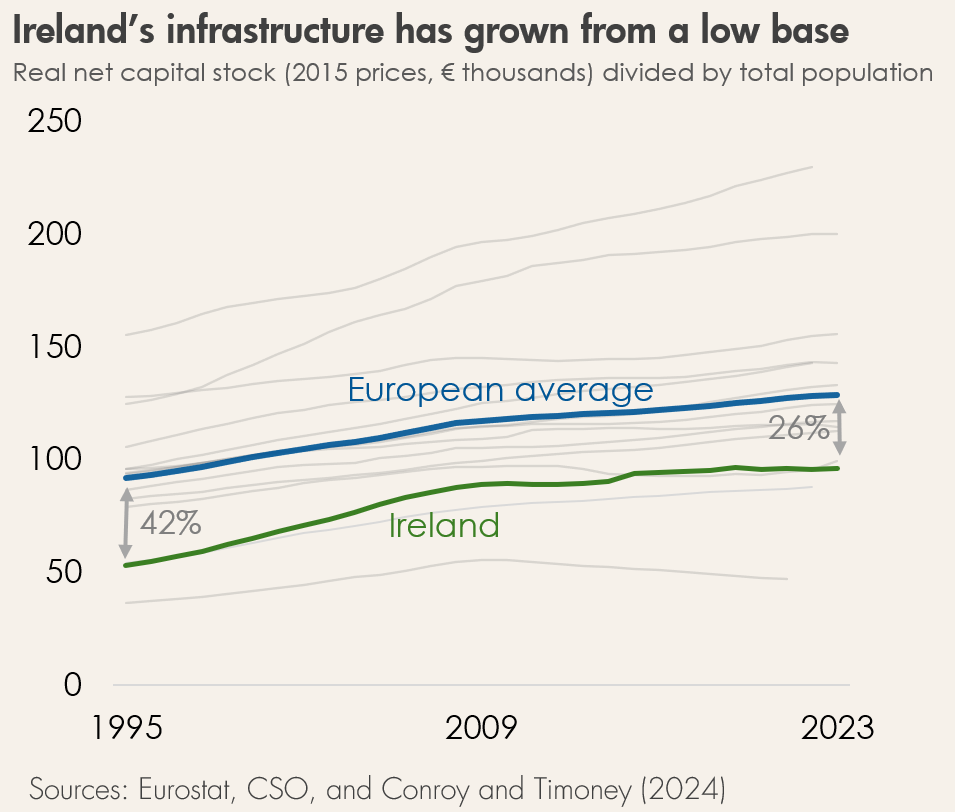

Compared to other high-income European countries, Ireland has historically had a low level of infrastructure. This is not surprising—Ireland has only relatively recently become a high-income country. In the 1970s and 1980s, Ireland did not have the financial resources to invest in its infrastructure.

By the mid-1990s, Ireland’s infrastructure was about 50% lower than that of other European countries. While progress has been made since then, a gap of around 25% still remains. In short, it’s a case of “a lot done, more to do”. EU Structural Funds provided funding to upgrade Ireland’s infrastructure in the 1990s and early 2000s.

Where are the gaps?

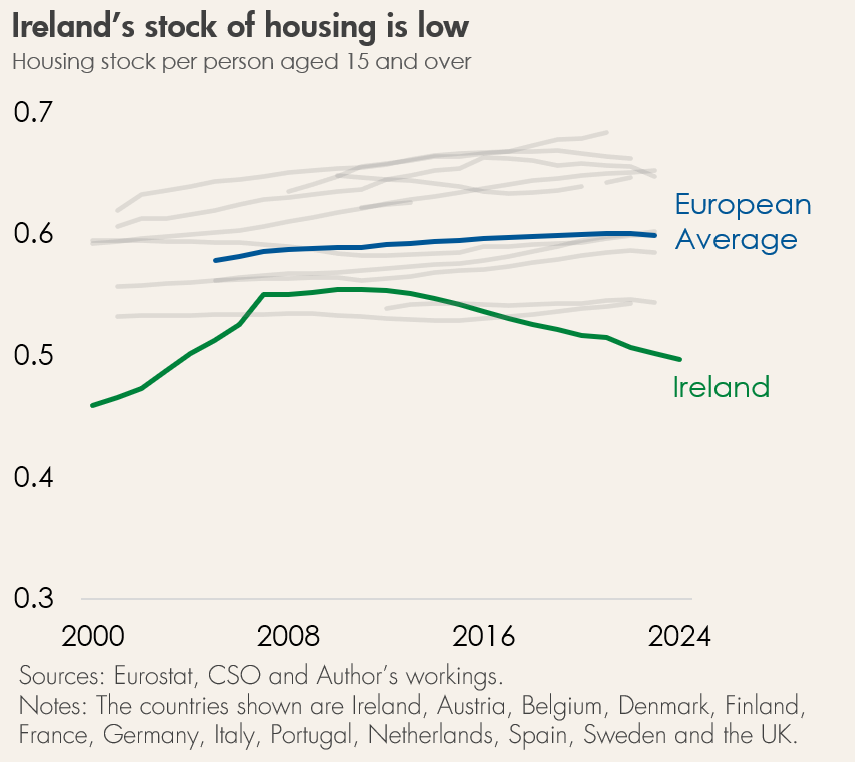

Ireland faces significant infrastructure shortages in four key areas: housing, healthcare, transport, and electricity. The housing shortage is particularly well documented. Since 2008, the supply of new housing has not kept pace with population growth. As a result, Ireland’s housing stock is estimated to be around 250,000 units below the European average (on a per capita basis). For citizens, this shortfall is most acutely felt through high rents and house prices.

Shortages of other supporting infrastructure make it harder to deliver housing. Difficulties and delays in getting new housing connected to the electricity grid have been cited. ESB Networks recently warned of limited grid capacity for new connections in some areas of the country. The Central Bank (2024) has highlighted a shortage of zoned land, particularly in Dublin.

Water and wastewater systems face similar pressure. Ireland’s water infrastructure is broadly in line with that of other high-income European countries.

However, Ireland’s economy places significant pressure on water. This is due to the strong presence of water-intensive industries like pharmaceuticals, data centres, and semiconductors. Water infrastructure is also vital for housing. Uisce Éireann has said it can only support 35,000 new homes annually without further investment, far short of national targets.

How do we fix this?

Upgrading Ireland’s infrastructure will not be straightforward. It will take many years of sustained investment in specific areas. Most of the required infrastructure can’t simply be imported; it must be built by workers based in Ireland. With unemployment already low, finding enough workers to deliver these projects will be a major challenge.

We estimate that Ireland needs 80,000 more construction workers—a 45% increase—to deliver the infrastructure we need. Inward migration, workers moving from other sectors into construction, and expanded training and apprenticeship programmes can help. But these measures alone won’t fully bridge the gap.

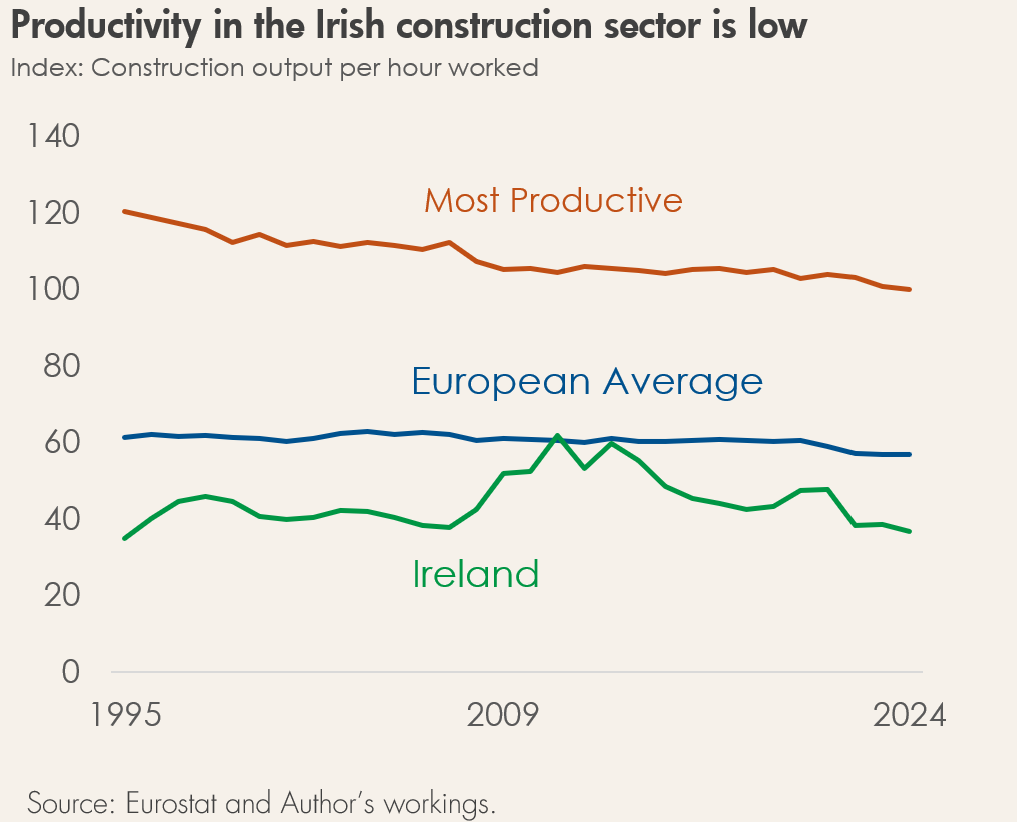

Increasing the productivity of the existing construction workforce would help. Currently, productivity in Ireland’s construction sector is 30% below the European average.

Why is construction productivity low?

Low construction productivity is partly a legacy of the financial crisis, when many construction firms went bust. Those that survived have, understandably, been cautious about investing in new technologies or manufacturing facilities. These firms know how quickly Ireland’s construction sector can swing from boom to bust. As a result, modern construction techniques are also less widely adopted in Ireland.

Ireland’s construction sector is dominated by small- or medium-sized firms. Just 9% of employment is in large firms—where productivity tends to be higher.

There are several reasons why Ireland’s construction sector is dominated by small firms. As a relatively small country, Ireland may lack the scale needed to attract large international construction companies.

Limited availability of land is another factor. Recent analysis has highlighted a shortage of zoned land in urban areas, especially Dublin. This often means that only small parcels of land are available for development. Naturally, these lead to smaller-scale projects, which are typically taken on by smaller firms.

This post draws on analysis from Niall Conroy and Kevin Timoney (2024), titled “Ireland’s Infrastructure Demands”, available here.

See also Central Bank (2024), “Economic policy issues in the Irish housing market”, available here.

Next week’s blog will focus on the revised National Development Plan and the barriers to building infrastructure in Ireland.

The opinions expressed and arguments employed in this paper do

not necessarily reflect the official views of the Fiscal Council.