How might US tariffs and policy changes affect Ireland’s corporation tax receipts ?

Brian Cronin

November 2025

Fiscal Council Analytical Note Nº21

Summary

The U.S. has introduced wide-ranging policy changes this year. These include tariffs and other trade measures. A key question is how these changes might impact Irish corporation tax revenues. This paper attempts to answer that question.

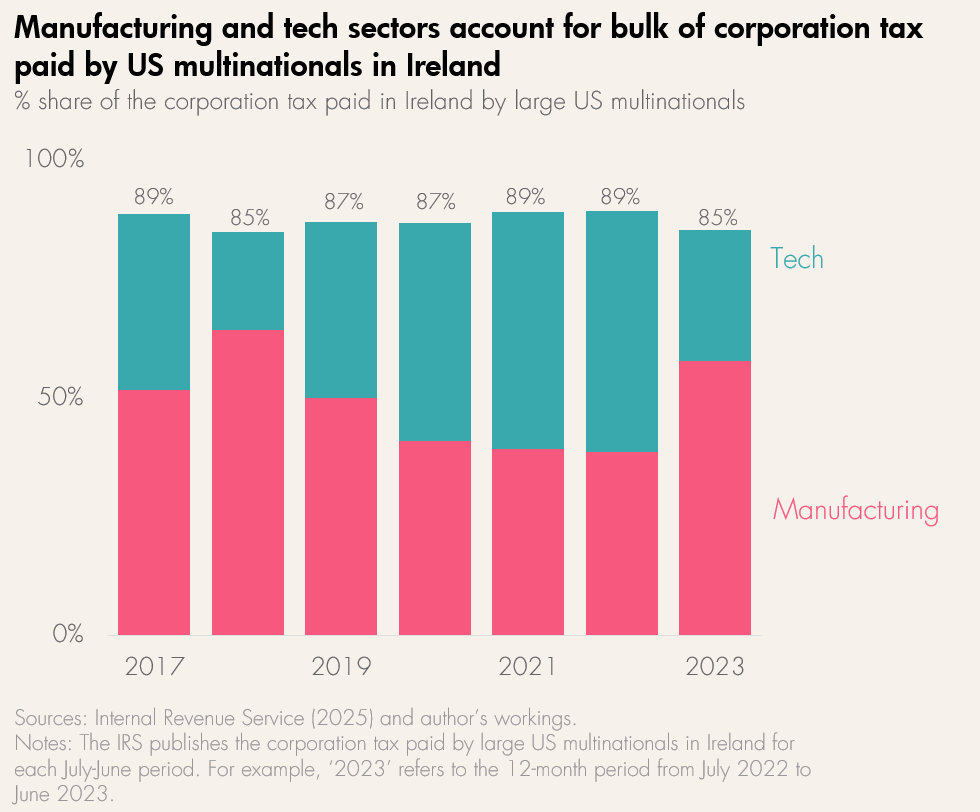

Corporation tax now accounts for well over one-quarter of Ireland’s total tax receipts. Around three-quarters of it comes from large U.S. multinationals. Just two sectors—tech and manufacturing (mainly pharma)—account for about 87% of the corporation tax paid by large US-owned firms here. Both the tech and pharma sectors have avoided US tariffs to date.

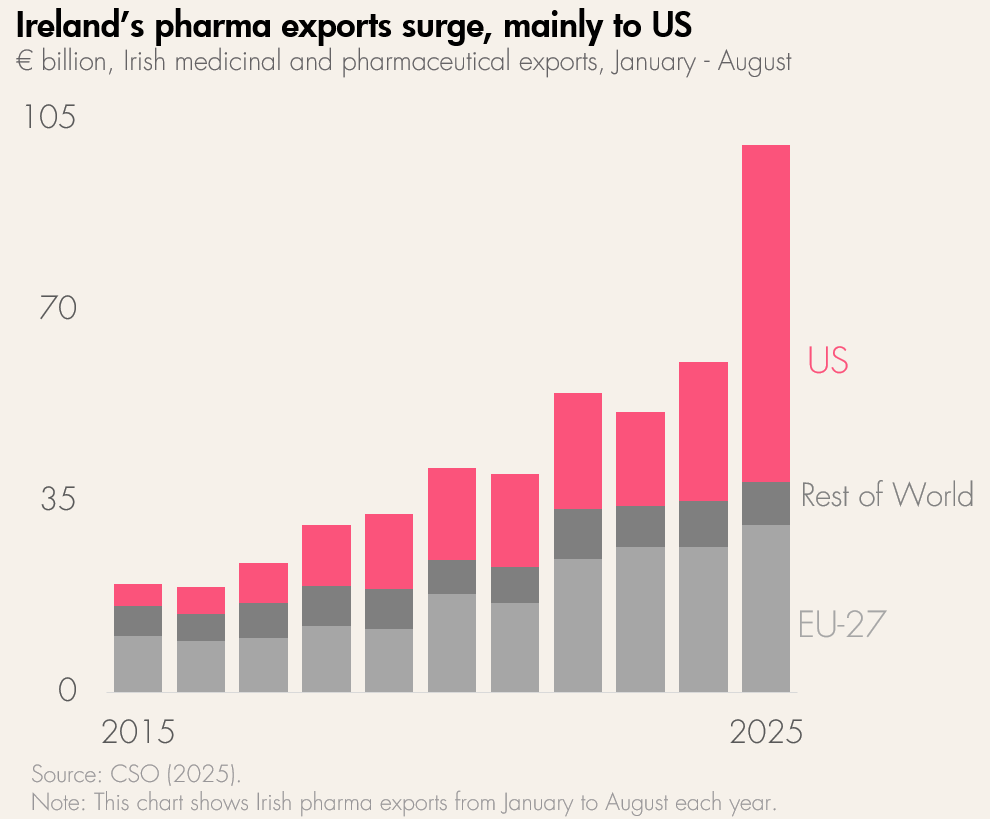

Ireland’s corporation tax revenues could be even higher than they might otherwise have been in the short term. This is because one large pharma group frontloaded some exports to the US ahead of the expected tariffs.

Ireland’s corporation tax revenues have become more risky. That is, future receipts could be much higher or lower than current levels.

On the upside, profits in the tech sector are likely to increase further, aided by advances in artificial intelligence and strong underlying demand for their products and services. In the pharma sector, Ireland appears to be a key manufacturing hub for the active ingredient used to make hugely popular weight-loss and diabetes medicines. These medicines are extremely profitable, and their sales are forecast to grow significantly. All the while, Ireland has also introduced a 15% minimum effective tax rate for large firms, as part of the OECD’s Pillar II reforms. This will yield additional revenue from mid-2026.

On the downside, the pharma sector could face tariffs. In addition, there are also policies in motion to reduce drug prices in the US. For the tech sector, the longer-term prospects remain unclear. They depend on whether large investments in artificial intelligence generate higher profits, which is still uncertain. More generally, corporation tax in Ireland is sensitive to changes in international tax regimes, as well as further changes in tax, trade and industrial policy in the US.