This is one of the Council’s main reports. Two such reports are published each year.

This report assesses Budget 2026. It looks at the economic environment, the overall fiscal stance, the forecasts, and how it complies with fiscal rules.

Report

Additional materials

- Data Pack

- Press Release

- Briefing Presentation

- Supporting items (additional analysis)

- Endorsement note

- Response of the Minister for Finance to the Fiscal Assessment Report, November 2025

Summary

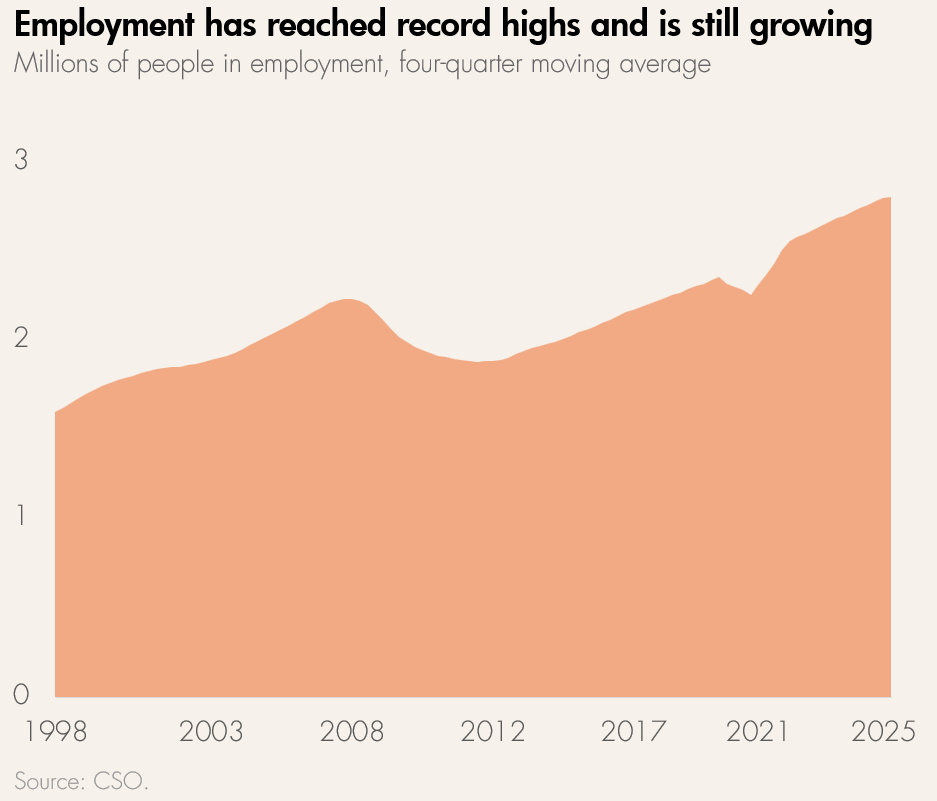

The Irish economy is in a strong position. Employment has reached a record high and is still growing. The Irish economy does not require support from budgetary policy.

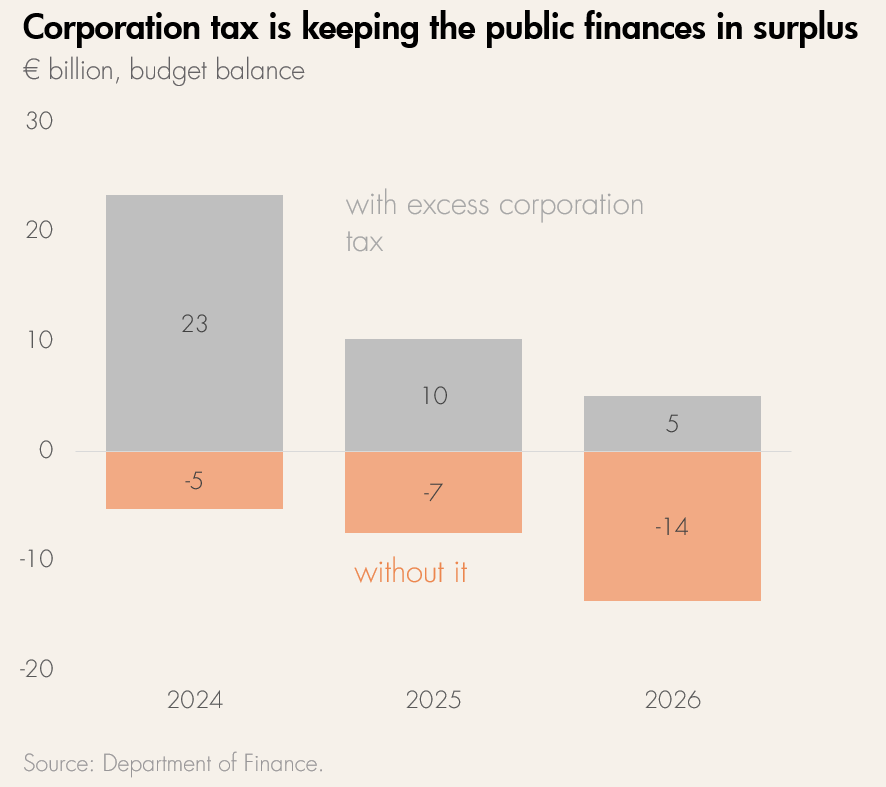

On a headline level, the public finances are healthy. However, surpluses are driven by extraordinary corporation tax receipts.

Ireland is going to face large budgetary challenges in the decades ahead. Costs from an ageing population and climate change are equivalent to €20 billion in todays money.

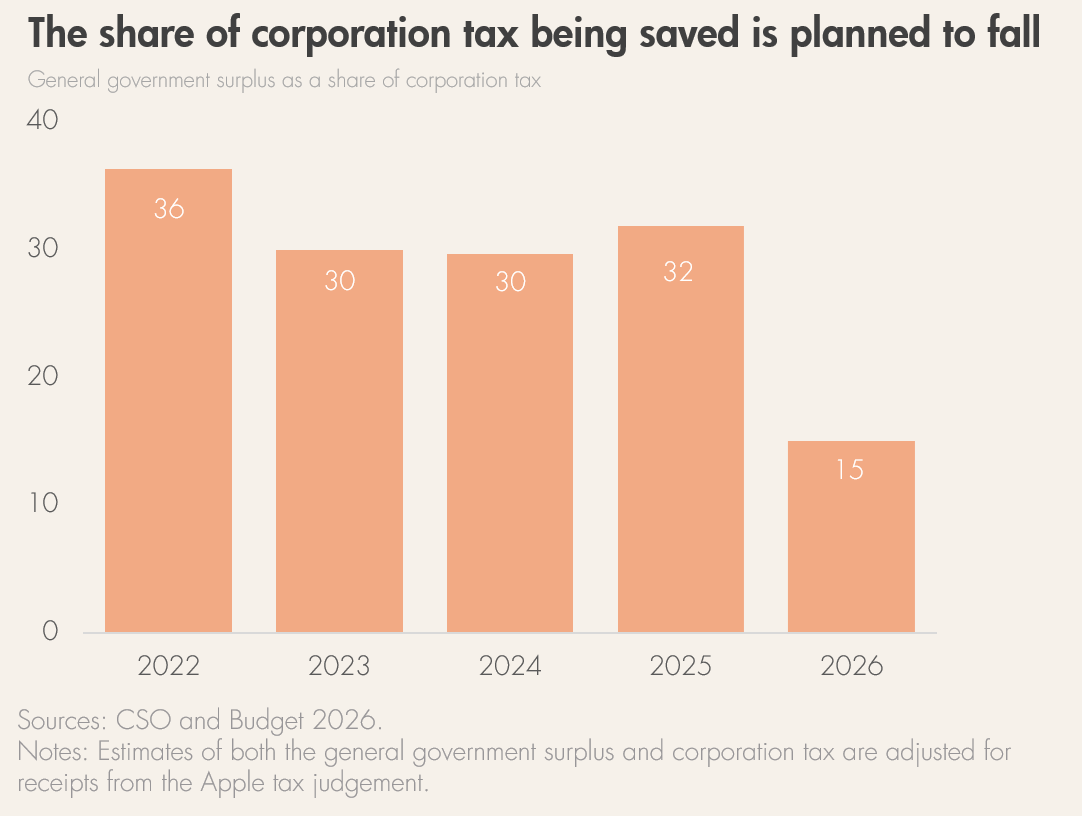

Against this backdrop, budgetary policy is adding money into the economy when it is not needed. The government is planning on spending most of its corporation tax receipts. Only 15% of corporation tax receipts will be saved next year, down from 32% this year.

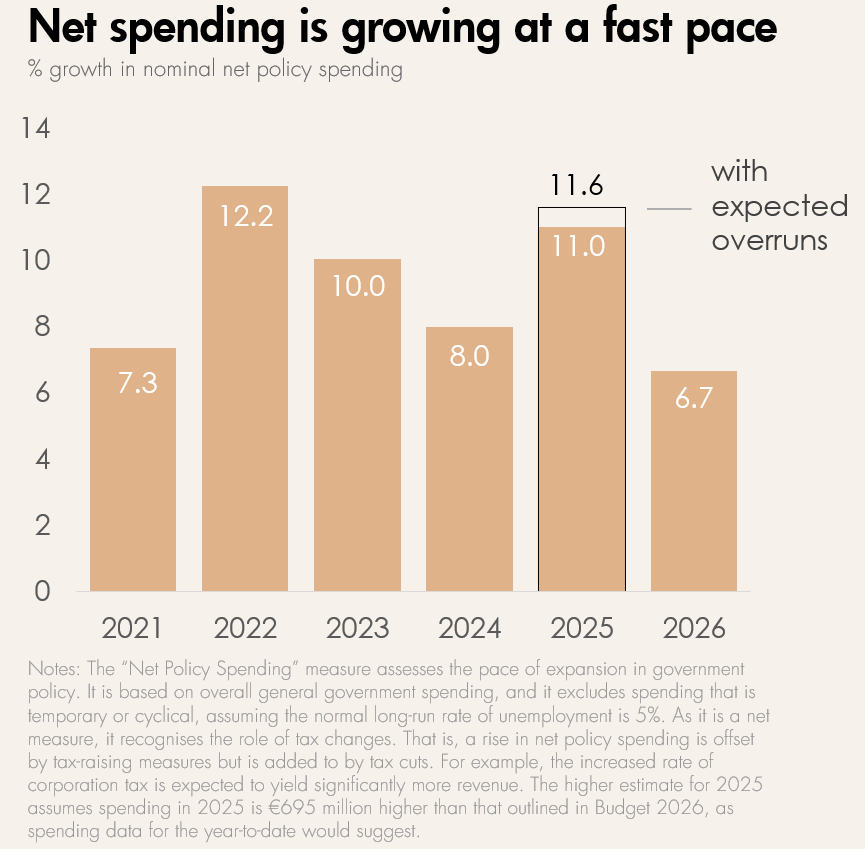

Spending (net of tax measures) is still rising at a fast pace. Budget day forecasts suggest a slowdown in spending growth next year. Given the pattern of spending overruns in recent years, government expenditure may grow faster than Budget 2026 figures suggest.

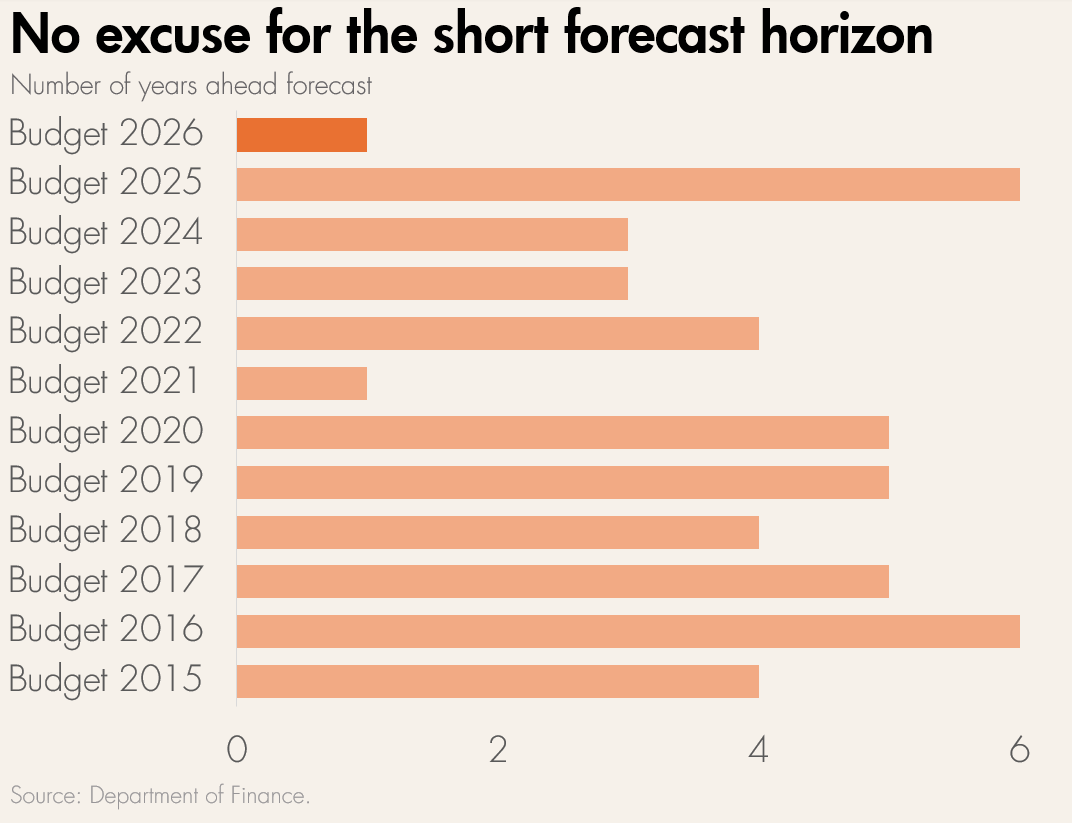

The Government is budgeting like there’s no tomorrow. There are no budgetary forecasts beyond 2026. The Government is also yet to submit a revised medium term fiscal plan to the European Commission.

The Government needs to move away from year-to-year budgeting. Moving to multi-annual budgeting would give government agencies more certainty over their future funding. This would aid better planning and delivery of public services.