Introduction

The Fiscal Responsibility Act 2012 established the Irish Fiscal Advisory Council (“the Fiscal Council”) as an independent state body. This is the Fiscal Council’s fourth strategic plan.

Mission

The Fiscal Council’s mission is to support the effectiveness of fiscal policy in the near and medium-term through delivery on each element of its mandate as an independent fiscal institution.

Vision

The Fiscal Council’s vision is for an economy with broadly based growth in incomes and employment founded on sustainable macroeconomic and fiscal policies.

Values

The key values of the Fiscal Council are:

- High quality analytical output.

- Independence and integrity.

- Openness, objectivity and transparency.

- Highest ethical standards.

Background

Mandate of the Fiscal Council

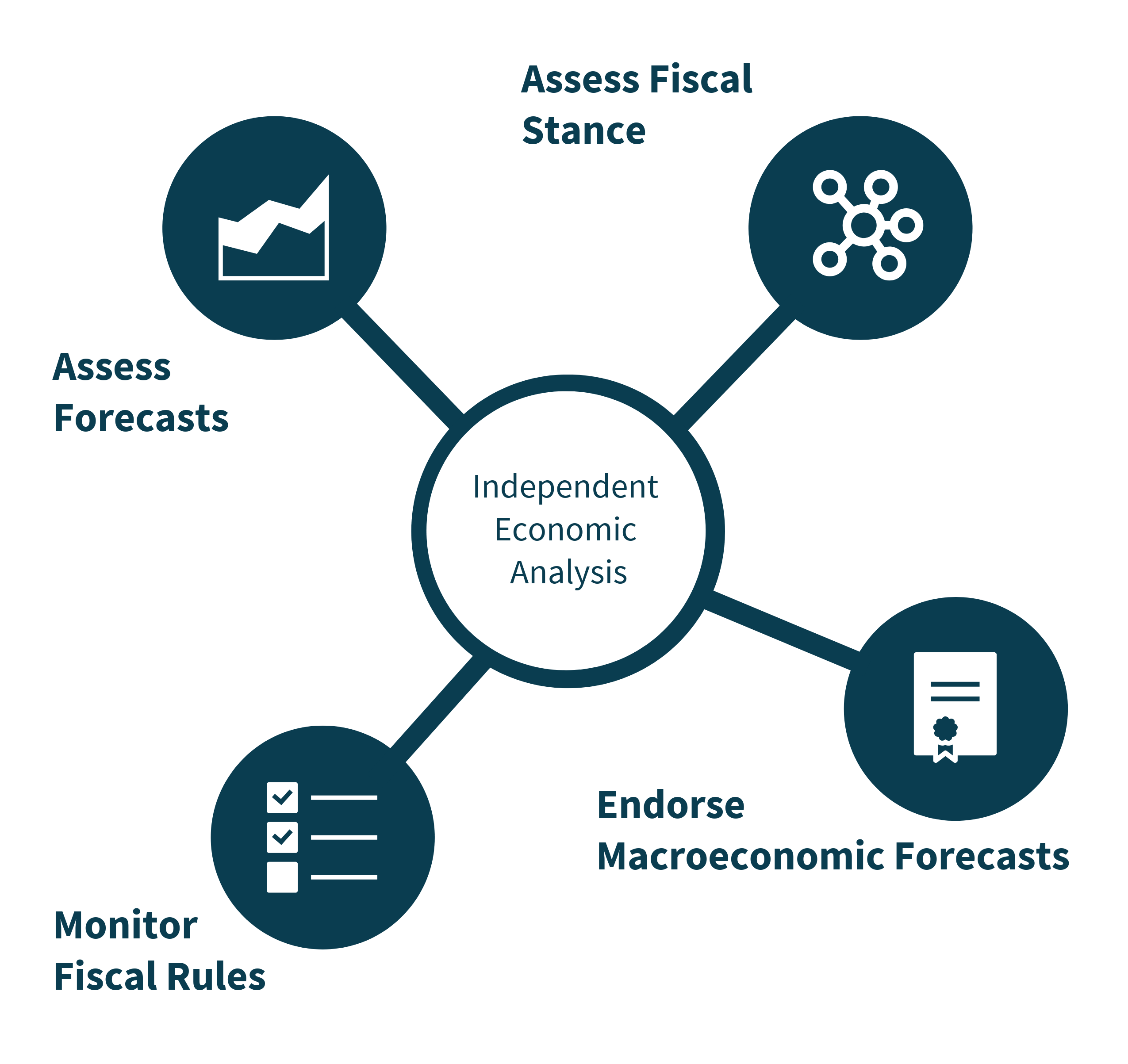

The Fiscal Council has four legally mandated functions. The first three were assigned in the Fiscal Responsibility Act 2012 [1]. The fourth function (endorsement) was assigned to the Fiscal Council in July 2013 [2].

- To assess the official forecasts produced by the Department of Finance and published in the Stability Programme and in the Budget.

- To assess the fiscal stance of Government, and specifically whether it is conducive to prudent economic and budgetary management, with reference to the EU Stability and Growth Pact.

- To monitor and assess compliance with the Budgetary Rule [3].

- To endorse the official macroeconomic forecasts prepared by the Department of Finance in relation to each Budget and Stability Programme. This follows revised European requirements to have national medium-term fiscal plans and draft budgets based on independent macroeconomic forecasts, which means macroeconomic forecasts produced or endorsed by an independent body. A joint Memorandum of Understanding between the Fiscal Council and the Department of Finance underpins the endorsement process [4].

The Fiscal Council produces biannual Fiscal Assessment Reports as well as an annual Pre-Budget Statement. Reports are submitted to the Minister for Finance and subsequently published within ten days. The Fiscal Council also submits its Annual Report to the Minister who arranges to lay the Report before each House of the Oireachtas. The Council chairperson may also be required to appear before the Oireachtas in relation to its activities.

In relation to the endorsement function, the Council is required to provide a formal letter to the Secretary General of the Department of Finance at least five working days before the Department publishes the Budget and Stability Programme [5]. If the Council were to conclude that it had significant reservations about the preliminary or “provisional final” macroeconomic forecasts, it would immediately communicate these informally to the Department. If, following further discussions, the Council were still not in a position to endorse the macroeconomic forecasts underlying the Budget or SPU, the Chair would write to the Secretary General explaining why this was the case, at least five working days before the Department publishes the Budget or SPU.

To support the Fiscal Council’s delivery of its mandate, the Fiscal Council also produces ad hoc reports including Analytical Notes, Working Papers and other analytical work on the Irish economy, macroeconomic forecasting, and fiscal policy.

Current Position of the Council and Progress to Date

The Minister for Finance appointed the Council’s five members based on their experience and competence in domestic and international macroeconomic and fiscal matters. The current Council has a strong international dimension with four members based outside of Ireland.

The Secretariat comprises of a Chief Economist, two Economists, two Research Assistants, and an Administrator.

The Council was established in 2011 on an administrative basis and on statutory basis in 2012. To date, the Council has published 23 Fiscal Assessment Reports, 9 Pre-Budget Statements, 19 endorsement letters, 18 Analytical Notes, and 17 working papers.

Two independent peer reviews of the Council have been conducted. The first in June 2015, and the latest in February 2021 by the OECD. The latter concluded that:

“The Council has been an important institution in Ireland, helping to spread greater understanding around fiscal policy over a time period when there has been a drive for Ireland to improve fiscal management. The work of the Council is highly regarded by peers, and it is viewed as independent by those on all sides of the political spectrum.”

However, the OECD (2021) review made recommendations to ensure the Council was to continue to perform well relative to international standards. These included aspects related to how its budget is set, legal underpinnings for access to information, and adjustments to leadership arrangements, such as advertising the Chair role as up to half-time instead of part-time. These recommendations help inform the Council’s latest strategic plan.

Key Challenges, Risks and Opportunities in our Operating Environment

Key Challenges

- Visibility: It is essential for the Fiscal Council’s effectiveness to maintain visibility of its assessments. While it has managed to build a strong voice in the domestic debate around fiscal policy, it needs to continue to build awareness of its mandate and assessments, which cover key government decisions, in a crowded field of public debate, while ensuring that credibility is maintained

- Administrative burden: Achieving all elements of its mandate and expanding on Fiscal Council’s analytical output is a challenge, given the small size of the Secretariat.

- Data/informational asymmetries: Government departments and bodies may have more granular information that cannot be accessed by the Council for its analysis.

- Capacity: The Council’s resources are small and it is now approaching its budget ceiling. This has constrained the Council’s ability to sustain output and to respond to changing circumstances or new analytical requirements. It has meant that the Council has not been able to maintain a staff position that was primarily involved in the area of long-term analytical work. This constraint could in the future impact the Council’s ability to deliver its legal mandate. The OECD (2021) Review recommended changes to how the Council’s budget is set, including linking it to changes in its main costs. The Council is involved in ongoing discussions with the Department of Finance to implement the OECD’s recommendations in this regard.

Risks

- Small size of Secretariat: The Fiscal Council is at risk if staff were to suddenly leave or to take periods of extended absence as there is limited scope for duplication of skill sets resulting in reliance on key personnel.

- Independence: Although the Fiscal Council’s independence is underpinned by legislation, there is a possibility that these protections could be reduced in the future or other measures could be taken to undermine the Council.

- Changing environment: Wider changes to economic conditions, political changes, or developments in the EU and Irish institutional frameworks might limit or weaken the role of the Fiscal Council in contributing to prudent and sustainable fiscal policy.

- Reliance on goodwill: The Fiscal Council is highly reliant on information from government departments and agencies, which is provided by goodwill rather than formal information-sharing arrangements. If this goodwill were to diminish, access to information could become more constrained. The OECD Review recommended that the Council should have a statutory right to information.

- Conflict with Government: The Fiscal Council may be required to risk controversy by publishing criticisms of Government policy or unwelcome advice where the Council considers that it is warranted. This is in line with its independent role and mandate.

- Organisational risks: Disruption to existing service-level agreements could severely impede the functioning of the Council.

- Conflicts arising between the technical application of the fiscal rules and overall recommendations on the fiscal stance: There is a risk that the Fiscal Council’s assessments — which reflect its assessment of the broader fiscal stance and which draw on the Council’s “principles-based approach to the fiscal rules” — might conflict with European Commission’s assessments of the rules or with changes to the EU fiscal governance regime. This could weaken the credibility of the fiscal framework or lessen the impact of the Fiscal Council’s assessments.

Opportunities

- Deeper analysis/research: The Council could develop richer analysis in areas related to long-term fiscal sustainability as the population ages and fiscal risks, building on its 2020 Long-term Sustainability Report. This is something that many stakeholders have called for including those participating in the OECD (2021) Review. However, due to it not been able to maintain a staff position primarily involved in the area of long-term analytical work, the Council’s ability to develop work in this area is constrained. This would require lifting current budget constraints.

- The Government’s introduction of a medium-term spending rule: This framework could help to avoid procyclical fiscal policy, but needs to be supported by other institutional measures and better long-term forecasting and planning. The Council’s work and increasing its medium- and longer-term focus could help to achieve this.

- Greater role in relation to the fiscal governance: The new communication from the European Commission (2022) calls for a greater role for independent fiscal institutions, such as the Fiscal Council, in relation to how the EU fiscal rules operate. This could potentially mean that the Council has a more direct role in terms of assessing the appropriateness of fiscal requirements).

- Increased visibility: The Council will continue to make its output more visible and engage more strongly with relevant stakeholders, including public bodies, the general public, and through greater outreach to universities.

- European and domestic agenda: The Fiscal Council could continue to play a role in the European and domestic debate on fiscal rules, structures, and economic governance. This includes through its continued active participation in the independent Network of EU Independent Fiscal Institutions).

Strategic Goals

Central Goal: Deliver on all Elements of our Mandate

| Goal | Outputs |

|---|---|

Assessment of:

|

The Fiscal Council will:

|

Endorsement of:

|

|

Supporting Goal 1: Ensure Compliance with all Requirements for a Statutory Body

| Goal | Outputs |

|---|---|

| Publication of Annual report and a set of financial accounts. | The Fiscal Council will:

|

| Independence and transparency. |

|

| External review of Fiscal Council operations. |

|

Supporting Goal 2: Promote Awareness of Fiscal Policy issues

| Goal | Outputs |

|---|---|

| Two Fiscal Assessment Reports and a Pre-Budget Statement every year |

|

| Analytical Notes and Working Papers |

|

| External communications and awareness of the Fiscal Council |

|

Achieving Our Goals

| Goal | Outputs |

|---|---|

Economic Forecasting:

|

|

| Public Finances. |

|

| Fiscal Rules. |

|

| Full-time six-person Secretariat. |

|

| Stakeholders. |

|