30 July 2025 – Beyond the Budget Blog Series

Implementing the right policy requires timely and accurate information. This is as true for small policies as it is for big policies. In times of crisis, the premium on reliable and timely information becomes even higher, as decisions often need to be made quickly and under intense uncertainty.

One of the most important measures of how the economy is doing is how much households are spending and what they are spending on. Unfortunately, Ireland does not have timely and reliable information on this. The household consumption estimates produced by the Central Statistics Office (CSO) are often heavily revised—and predictably so. Sometimes it can take years before we get reliable information on what has happened in the current year. This limits the usefulness of these estimates in guiding policy.

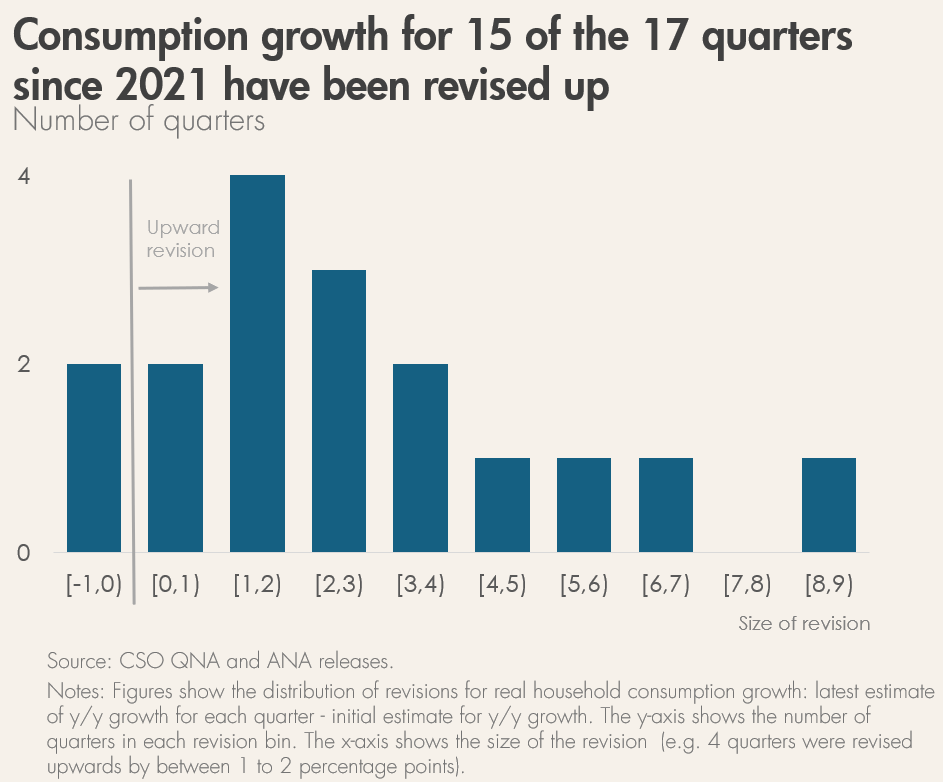

The chart below shows how the initial estimates of consumer spending have been revised for each quarter since 2021. Ideally, we’d expect these revisions to be small and centred around zero—meaning the first estimates were fairly accurate and not biased in one direction. But the chart clearly shows that’s not the case. Most of the revisions are positive, which means the initial estimates usually underestimated actual spending. Some of these revisions are quite large, with a few quarters showing increases of more than 4 percentage points.

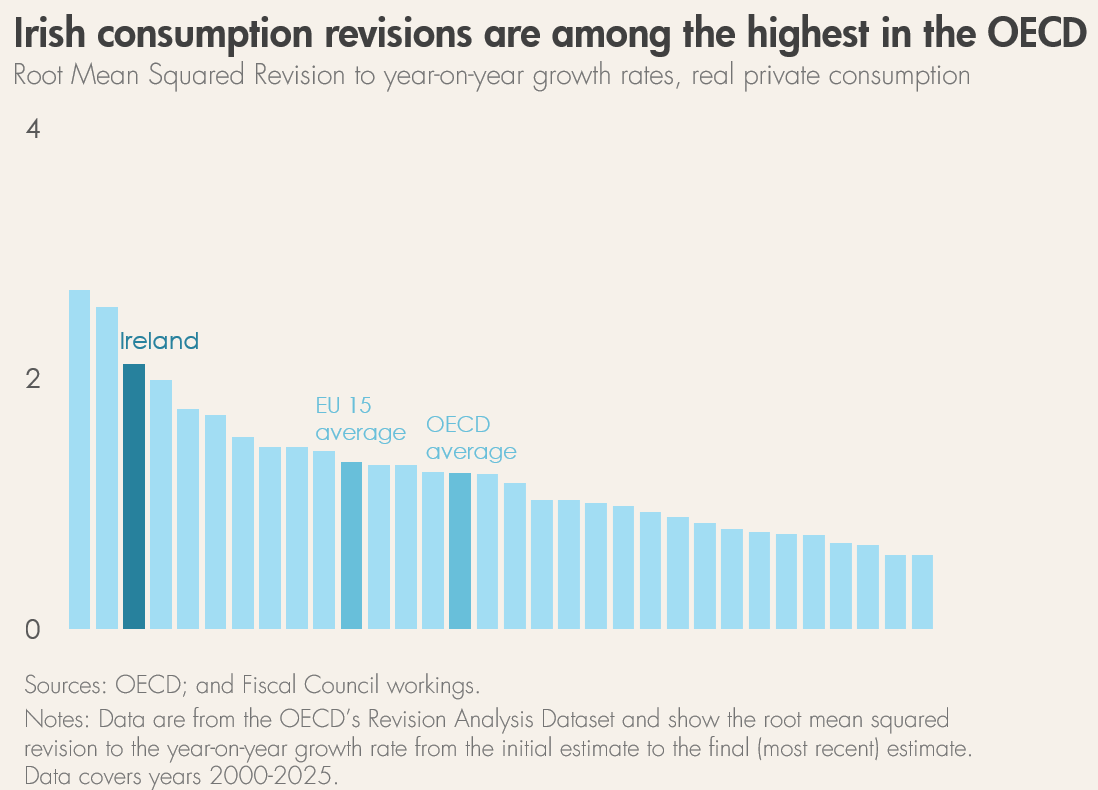

That being said, some revisions are inevitable, particularly as new information becomes available. However, the accuracy of initial estimates of consumption in Ireland is poor relative to international peers. The figure below shows the average size of revision to the year-on-year consumption growth rates between the initial estimate and the final estimate for OECD countries. The revisions to the Irish data are the third largest in the OECD at an average of 2.1 percentage points. This is almost double the OECD average of 1.25 percentage points.

In the past few years these revisions were somewhat predictable, given the strong growth in other high-frequency indicators like VAT receipts and bank card payment data. This suggests that the CSO are not making the best use of all available information when producing the initial household consumption estimates. The initial household consumption estimates are clearly an area of improvement for the CSO.

In recent work, the Council has tried to make better use of detailed granular card payment statistics published by the Central Bank, to estimate monthly consumption (Carroll, 2024). This data assigns each business a code. From this code, we can link the money spent in that business to a category of household consumption. This allows us to get a good understanding and reliable estimate of households’ consumption patterns in real-time.

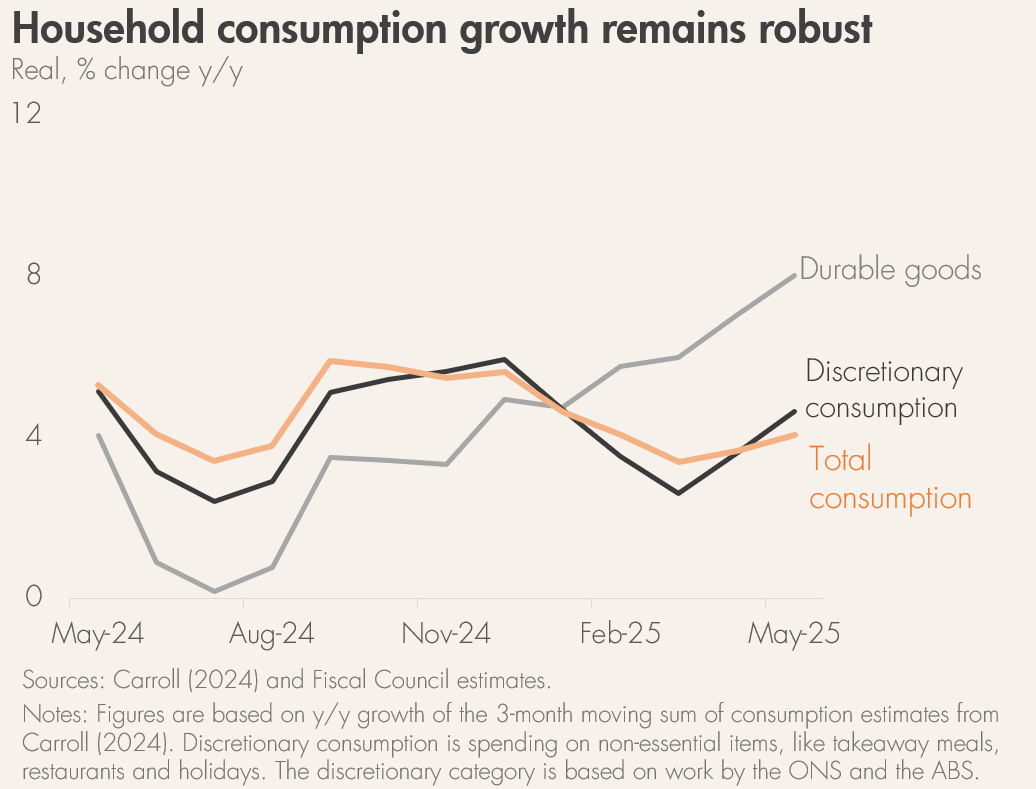

This data suggests that household consumption grew by 3.4% year on year in the first quarter of 2025. In contrast, the CSO’s initial estimate for the first quarter suggested growth of only 2.5%. The CSO have subsequently revised their estimate up to 3%, closer to the Council’s estimate. The CSO’s estimate may yet be further revised.

A useful breakdown of the card spending data is to split consumption into items that are necessities and items that are discretionary. Necessities are things like rent, electricity, and basic food items, whereas discretionary items are things like meals out, concerts or Netflix subscriptions. In bad times, people might spend a little less on essentials, but they’re much more likely to cut back on discretionary items. As a result, tracking household expenditure on discretionary items can provide a good indication of a household’s financial position. The figure below shows household spending on discretionary items has remained relatively strong in 2025, with growth in May of 4.6%.

Another useful category of consumption to track is durable goods. These are long-lasting items that people don’t buy often—like fridges, vacuums, or jewellery. Because they last a long time, households might delay buying or replacing these if they get into financial difficulty. As a result, this measure can also provide an indication of the strength of households’ finances. Household purchases of durable goods has been very strong so far in 2025, with growth in May of 8% year on year. Taken together, these data suggest that household spending continues to be strong in 2025.

The CSO’s current approach to producing real-time estimates of consumption has significant shortcomings. There is scope for the CSO to improve its estimates by incorporating VAT and card payment data. Until that happens, these consumption estimates produced by the Council from the card spending data can provide useful information on how much consumers are actually spending in real time.

Thank you for reading. If you would like to be alerted to future blog posts and publications, you can subscribe to our mailing list by emailing admin@fiscalcouncil.ie . Our Beyond the Budget blog series is also available on substack.