VAT Rate changes and pass-through. Evidence from the Irish hospitality and tourism industry.

Killian Carroll

October 2025

Fiscal Council Working Paper Nº27

Summary

Value Added Tax (VAT) rate changes are a recurring policy tool used to raise revenue, change behaviour and regulate economic activity. However, the degree to which VAT rate changes are reflected in consumer prices—known as pass-through—varies across industries and time. Understanding VAT pass-through is crucial for evaluating fiscal policies’ effectiveness and their economic impact. Yet, little is known about their pass-through in an Irish context.

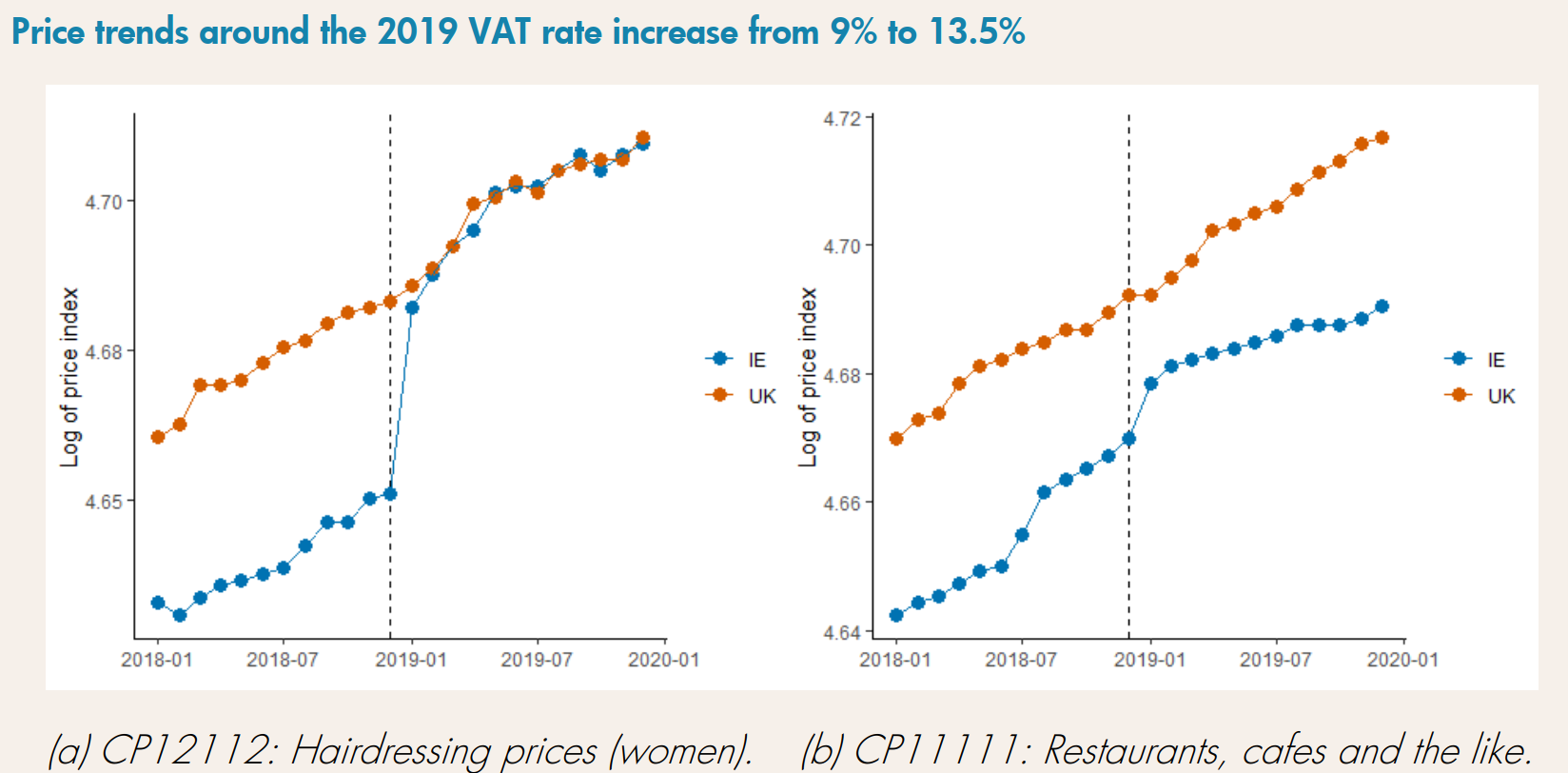

This paper examines the extent to which changes in VAT rates are passed through to consumer prices in the Irish hospitality and tourism sector. Using an event-study approach, this paper examines two VAT rate cuts (2011, 2020) and two VAT rate increases (2019, 2023). The research finds evidence of an asymmetric VAT rate pass-through, with VAT rate increases being passed through more than VAT rate cuts. The results vary across sectors too, with higher pass-through rates for hairdressing services than food and catering services.