15 October 2025 – Beyond the Budget Series

Ireland’s corporation tax revenues are highly concentrated in a handful of sectors. In this blog, we show how these revenues could be even more concentrated than official data suggests.

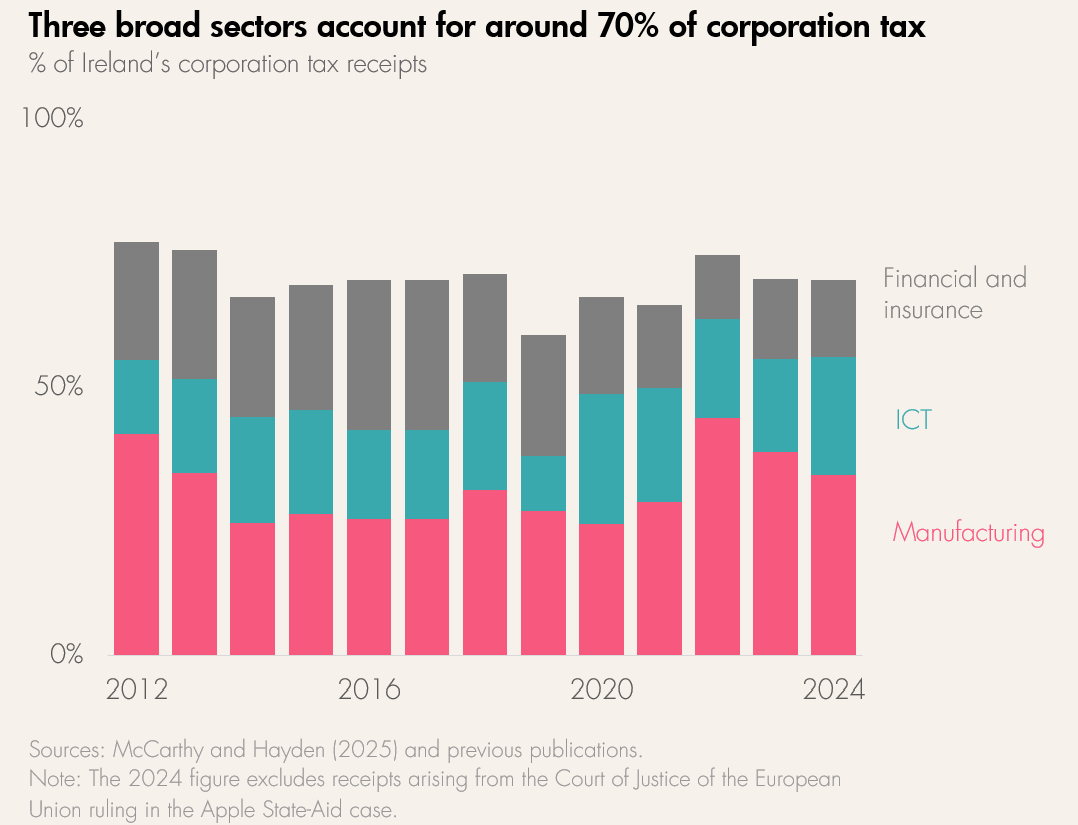

At first glance, corporation tax revenues are fairly concentrated

Since 2012, official data published by the Revenue Commissioners shows that about 70% of Ireland’s corporation tax revenues have come from just three broad sectors: manufacturing, information and communication (ICT), and financial and insurance activities.

However, this data likely understates the amount of corporation tax paid by the manufacturing and ICT sectors.

Corporation tax data should focus on the parent

Official data classifies each subsidiary based on the subsidiary’s own principal activity—the activity which generates most gross value added. For example, a pharma group’s treasury arm is classed as financial and insurance, not manufacturing (McCarthy, 2019).

Many ICT and pharma groups have subsidiaries involved in activities outside their main business, such as treasury operations. Some of these subsidiaries make sizable corporation tax payments (Cronin, 2023). The Revenue Commissioners reached a similar conclusion in an earlier study (see Piggott and Walsh, 2014).

For economic analysis, it is more appropriate to classify subsidiaries based on the principal activity of the group parent. Take the example of the treasury arm of a pharma group. Such a subsidiary often acts as a financing company, lending group profits to other group subsidiaries or engaging in investment trading and asset management activities on behalf of the group. Its principal risks and uncertainties are the same as those of the group. These risks would include things like products coming off patent, drug approvals, government regulation changes, and changes to senior management.

Under this classification, corporation tax receipts in Ireland would likely be more highly concentrated in two sectors: manufacturing (mainly pharma) and ICT. Financial and insurance activities would play a smaller role.

US data can shed light on the concentration of Irish corporation tax

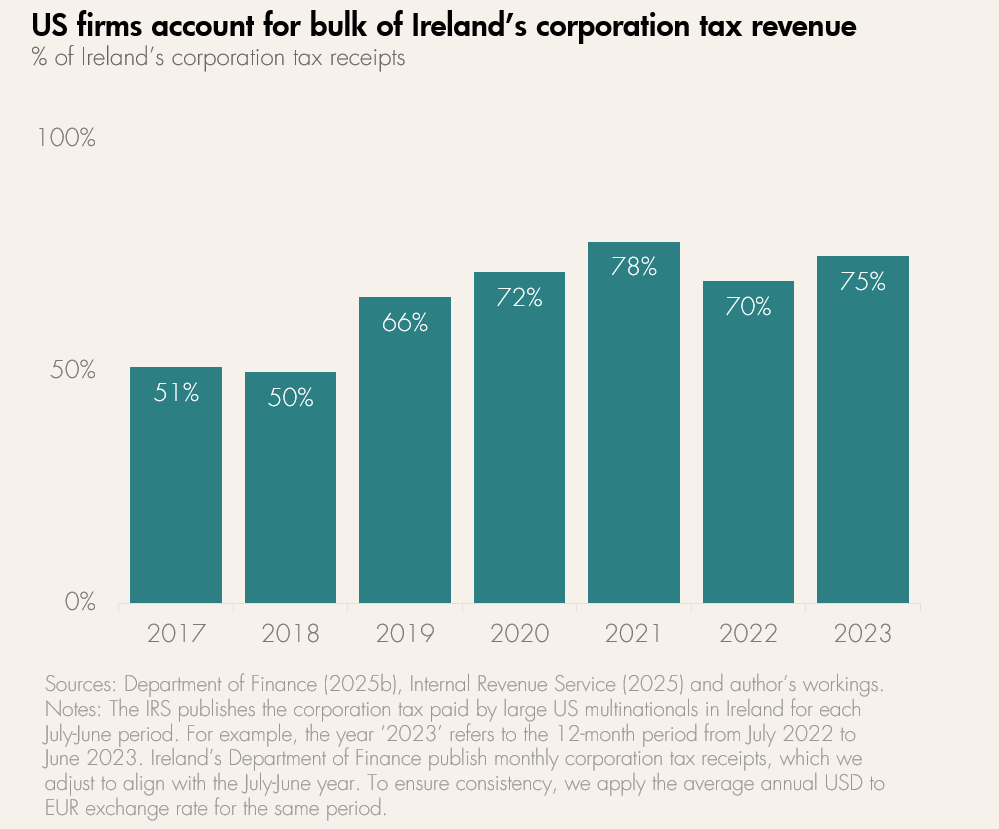

US multinationals are the biggest corporation taxpayers in Ireland. Cronin (2025) estimates that they account for around three-quarters of all corporation tax revenues (Figure 2). These receipts are linked to significant levels of economic activity. US multinationals directly employ around 220,000 people in Ireland, with thousands more jobs reliant on their presence here (Department of Finance, 2025). The US is also Ireland’s single biggest bilateral trading partner, accounting for nearly one-fifth of all Ireland’s goods and services exports in 2023.

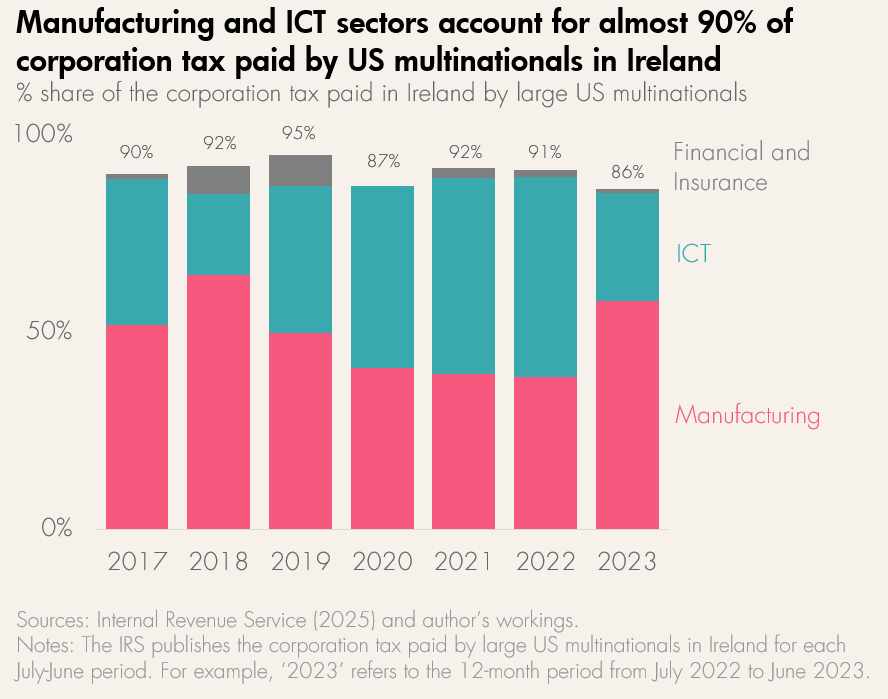

The Internal Revenue Service in the US collects country-by-country reporting data on revenue, profits, and taxes paid by jurisdiction for large US-owned multinationals. Importantly, its sectoral breakdown is based on the principal economic activity of the parent entity.

This alternative method of classifying subsidiaries paints a very different picture. The manufacturing and ICT sectors accounted for, on average, 87% of the corporation tax paid by large US-owned multinationals in Ireland between July 2016 and June 2023. What’s more, the share attributable to financial and insurance activities is much smaller— at no stage does it exceed 10% of the total corporation tax paid by US multinationals here.

Corporation tax is even more concentrated than previously thought

In summary, Ireland’s corporation tax receipts are likely to be even more reliant on ICT and manufacturing groups than official data would suggest. This is due to the fact that some firms, often classed as financial and insurance activities in official Irish data, are actually part of larger groups predominantly focused on manufacturing or ICT activity.

This matters when assessing how exposed Ireland’s corporation tax revenues are to tariffs and US trade policy changes more generally. So far, tariff hikes have focused only on goods, while ICT services have not been directly impacted—for now, at least. In a forthcoming analytical note, we will take a deeper look at the ICT and manufacturing sectors and assess where corporation tax receipts might be most vulnerable to US developments.

The opinions expressed and arguments employed in these blogs do not necessarily reflect the official views of the Fiscal Council.