This is the Council’s first Long-Term Sustainability Report. It looks at public finances over the coming decades to 2050, as the population ages and the economy continues to grow. Starting from a very high post-Covid-19 government debt level, it focuses on the implications for the sustainability of the Irish public finances given current trends and known risks.

- Long-term Sustainability Report: Fiscal challenges and risks 2025-2050

- Data Pack

- Report briefing presentation

- Methodology Report

Video briefing

Data visualisation story

Summary Assessment

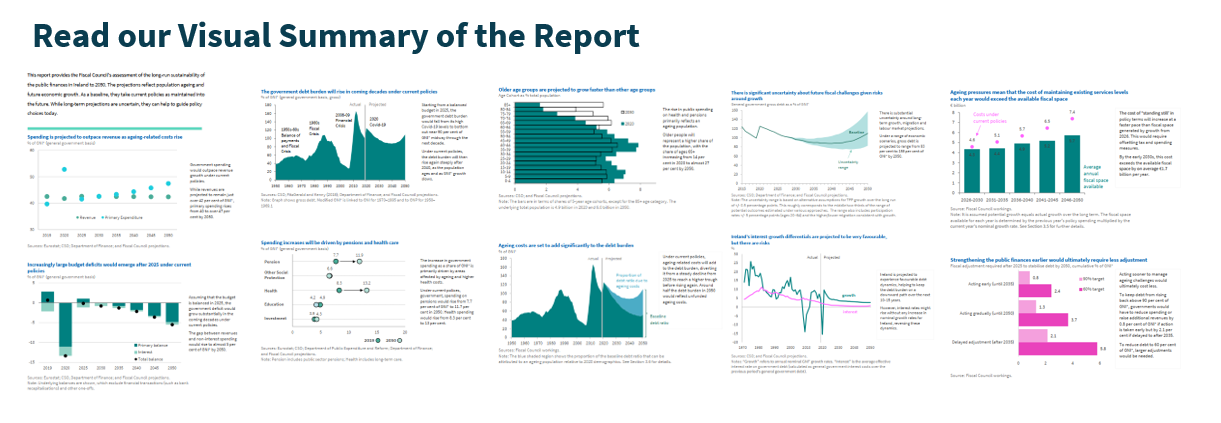

Covid-19 will have a major impact on the economy and public finances over the coming 5 years, yet there are serious long-term fiscal challenges ahead that should also form an important part of today’s budgetary decisions. This is the Council’s first Long-Term Sustainability Report. The report assesses Ireland’s long-term fiscal challenges and risks. The fiscal challenges arising from the legacy of very high government debt following the Covid-19 shock are being extensively discussed. Ireland’s low cost of borrowing, alongside some fiscal adjustment once the economy has recovered, should play a key role in returning the debt ratio to a safe downward path. However, longer-term challenges, including those associated with a rapidly ageing population and health care costs, have received less coverage.

Economic growth is set to slow over the coming decades. As a small, highly-open economy in the Euro Area and the European Union (EU), Ireland has achieved remarkable income growth averaging 3.1 per cent per year, over recent decades, in real terms. Yet, the pace of growth has slowed since 2000. This report projects that growth will slow further over the coming decades before converging to a long-run growth rate of around 1 per cent. This is largely driven by a slowdown in labour-productivity growth. Ireland currently has relatively high labour productivity compared to elsewhere in the OECD and the scope for “catch up” growth is therefore limited. A general slowdown in productivity growth across OECD countries over the past decade also suggests that economic growth could be expected to slow.

While Ireland has a relatively young population, this is projected to radically change in the coming decades. The number of people over the age of 85 is likely to increase fourfold between 2020 and 2050. By contrast, the rest of the population is projected to expand by much less, rising by just 17 per cent. This rapid ageing of the population structure marks Ireland out as one of the fastest-ageing populations in the EU; Ireland is catching up in terms of ageing.

A measure of Ireland’s ageing is the “old-age dependency ratio”. This ratio measures the population aged 65 and over as a share of those aged 15–64 and is projected to more than double from 22 per cent in 2020 to 47 per cent in 2050. While the share of older people in Ireland is relatively low today by European standards, the population will age relatively fast so that the dependency ratio will reach the current EU average by the mid-2030s. The ageing process is set to accelerate in the 2030s and 2040s.

The ageing of the population has major implications for public spending.Government spending on state pensions, public service pensions, health, and long-term care will increase in real terms as the population ages. Under current policies, combined spending on pensions and health care is projected to increase from 13.3 per cent of GNI* in 2019 to almost 25 per cent in 2050, particularly after 2030. T he projections assume that service levels remain constant and that social payments (such as pensions) rise in line with wages.

Without policy changes, spending growth will outstrip the rise in revenues, leading to large budget deficits after 2025. Without policy changes, the government deficit would gradually increase as a result of a growing and ageing population. Changing demographics will add to spending every year over 2026–2050.This incremental rise in yearly spending would have substantial impacts on the government debt burden over the long run. Unlike the impacts associated with Covid-19, these are likely to be long-lasting changes.

Under current policies, ageing costs prevent a larger decline in the debt ratio, and it will start to rise again from 2040. Reaching a budget balance by 2025 would, in the absence of ageing pressures, put the debt ratio on a steady downward path to safer levels. Very low interest rates are central to this outcome but should not be taken for granted. However, under current policies and due to ageing, projections suggest that the debt-to-GNI* ratio will only fall to around 90 per cent by 2040 and then rise substantially, reaching around 110 per cent of GNI* in 2050.

Ageing and health pressures mean the cost of maintaining existing services levels each year will exceed the available “fiscal space” — a yearly measure of available new resources. Government spending is set to increase at a faster pace in the late 2020s than the pace at which fiscal space will be created — that is, the amount of additional revenue created by economic growth. For 2026–2030, the fiscal space generated by sustainable growth will be more than fully absorbed just by maintaining existing policies. This will require tax or spending adjustments to maintain a fiscal balance. By the early 2030s, costs will exceed the available fiscal space by on average €1.7 billion (0.3 per cent of GNI*) per year.

To ensure long-term fiscal sustainability, policymakers need to adjust policies over time. The adjustment to policies could be achieved in different ways. Ageing costs could be managed through broad revenue-raising measures or through spending cuts. Building up large fiscal balances, creating a fund, and reducing debt more rapidly over the next decade are options that are similar in impact and could help to smooth future fiscal pressures. Within pensions, ageing pressures could be managed by reducing benefits through indexing to prices (rather than wages as assumed in this report) or other changes, by raising the retirement age or by raising PRSI contributions. This could be supported by developing a second contributory pillar or by encouraging more private pension saving. Measures to boost growth could also raise revenues. However, given the scale of the challenges, a combination of measures is likely to be needed.

Adjusting the pension age in line with rising life expectancy would make the system more sustainable. Despite significant improvements in life expectancy, the retirement age in Ireland has remained relatively constant over time. The pension age was 65 in 1980, rose to 66 in 2014 and current legislation stipulates an increase to 67 in 2021 and 68 in 2018, with no further increases anticipated to 2035. However, the new Programme for Government envisages keeping the pension age at 66 pending a review. By contrast, average life expectancy at age 65 has risen from 79 in 1980 to almost 85 in 2016 and is projected to rise further to 89, by 2050. Raising the pension age, as many other countries have done, would help to keep contributions and benefits closer to existing levels. A scenario where the pension age rises partly in line with life expectancy would produce annual savings of 0.3 per cent of GNI* initially, rising to 1.1 per cent of GNI* by the late 2040s relative to a situation where the pension age is unchanged at 66.

Strengthening the public finances earlier or making reforms sooner would reduce the scale of adjustment needed. Taking action earlier to strengthen the budget balance through increases in revenues or decreases in spending would ultimately require less fiscal adjustment overall. If these adjustments took place from 2026–2035, they would be less than half the scale of required adjustments if delayed until 2036–2050. Timely action to reform the pension system, including pension age increases, would reduce the impact of ageing costs.

A credible plan to address long-term pressures needs to be developed and implemented. Ireland has a mixed history in addressing pension reform with the pension age not having followed rising life expectancy and numerous official reports that have not lead to change, despite measures in some areas such as public sector pensions. Failure to implement the legislated increases in the pension age planned for 2021 and 2028 would raise spending and contribute to a rising debt burden over time. Not increasing the pension age as planned in 2021, for example, would add up to €575 million to annual spending, with this cost steadily rising over time. The proposed pension review set out in the Programme for Government should lead to credible commitments that ensure the sustainability of the pension system.

There is significant uncertainty about the scale of future fiscal and ageing challenges. Much will depend on Ireland’s productivity growth, participation in the workforce, and the extent to which demand for healthcare increases with incomes. Different plausible outcomes for some of the key macroeconomic variables could lead to gross government debt levels under current policies ranging from 83 to 158 per cent of GNI* by 2050.

The implementation of Sláintecare could add substantially to spending. Sláintecare—a large programme of reforms to how health care is provided in Ireland—is expected to lead to higher government health spending. While it could lead to cost-savings and reduce health costs to households, full implementation would be expected to add a further 1.1 percentage points of GNI* to government spending in 2030, rising to 1.2 percentage points by 2050 against the background of rising costs in healthcare.

Potential losses of corporation tax receipts remain an important fiscal risk. The OECD BEPS initiative is assumed in the baseline projection reduce receipts by €2 billion. In addition, other changes in the international tax environment could further impact on Irish corporation tax receipts. Based on the Council’s 2019 estimates of excess receipts, a further cumulative fall in annual receipts of €3.5 billion would put further pressure on the public finances.

Over the long term, climate change poses significant risks to fiscal sustainability. Climate change could significantly impact on economic activity and long-run growth prospects. In addition, some specific revenue items (including excise, vehicle registration tax, motor tax and carbon tax) are likely to be impacted as behaviour changes in response to climate change mitigation policies. While adapting the economy to lower carbon emissions may have positive effects on employment and investment, it may also carry costs for both growth and the public finances. As with other long-term fiscal challenges, delaying adjustment may ultimately be more costly.