Boston or Berlin? How Does Ireland’s tax and spending compare?Niall Conroy

August 2025

Fiscal Council Working Paper Nº26

Summary

Is Ireland a high-tax and high-spend country like many in Europe? Or is it more like other high-income countries outside Europe, which tend to have smaller governments? This paper examines these issues in detail.

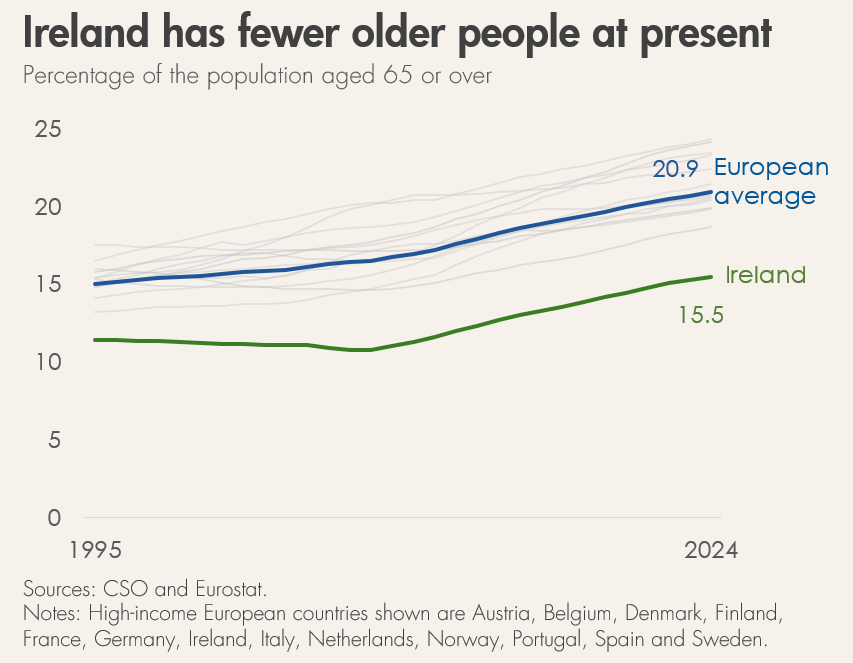

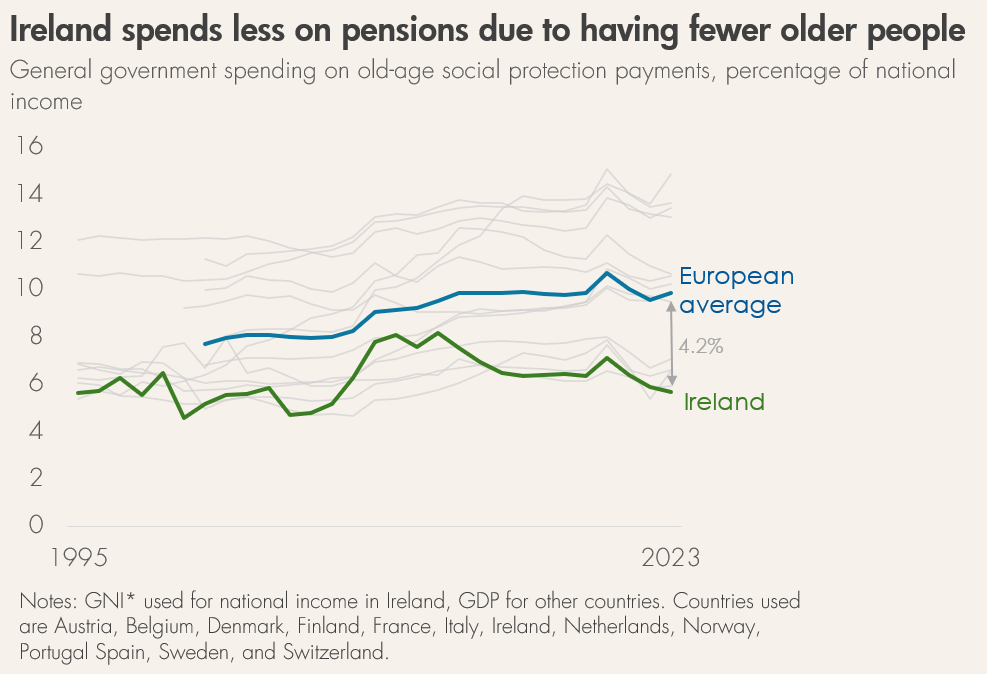

At the moment, the public finances in Ireland are benefitting from Ireland having an extremely young population. This means lower spending on pensions and healthcare than would otherwise be the case.

This younger population largely explains why Ireland has a lower level of government spending than other European countries.

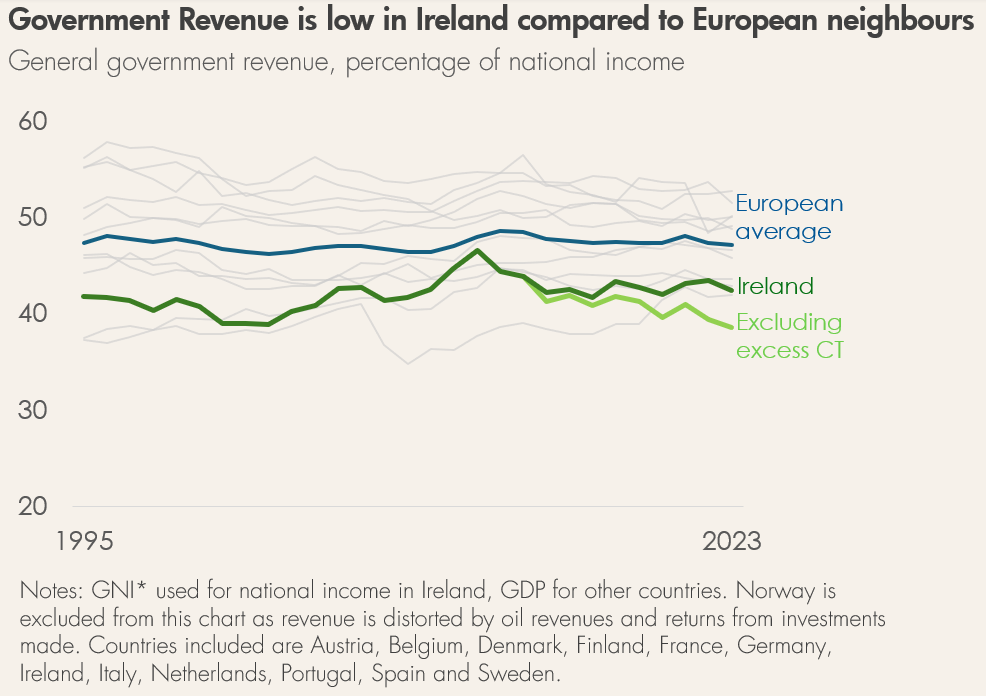

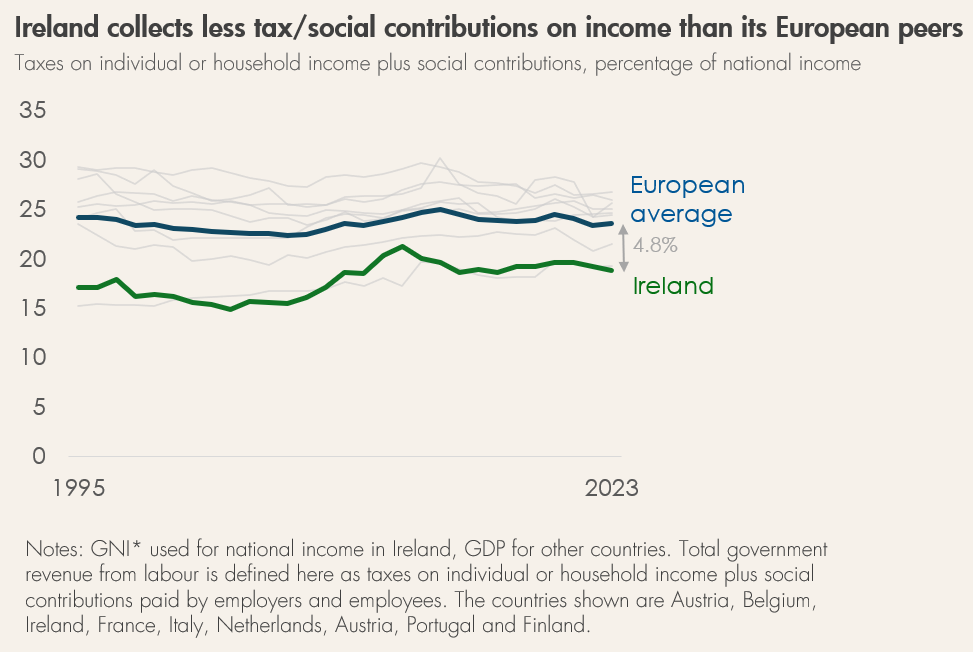

Ireland also collects a lower level of government revenue than other high-income European countries. This is despite Ireland collecting huge amounts of corporation tax.

This is mainly because Ireland collects less revenue from employment taxes than other high-income European countries. This gap is equivalent to €2,600 per person in Ireland.

As the population ages, this will lead to increased demand for pensions and healthcare. The Government’s recently established savings funds will help address these costs. But the funds alone will not be enough. So, the government will need to raise additional revenue or reallocate existing spending.

Data Pack and online appendices

The data pack includes some of the key charts and data in the report.