This is the Council’s main biannual report, the Fiscal Assessment Report.

The report assesses the Government’s Budget 2024 in terms of: the broad fiscal stance, the economic and budgetary forecasts, and Ireland’s compliance with fiscal rules.

- Fiscal Assessment Report, December 2023 (full report)

- Summary Assessment

- Data Pack

- Press Release

- Briefing Presentation

Boxes

-

- Box A: The inflationary impact of Budget 2024 tax cuts

- Box B: Revisions to Irish consumption data

- Box C: What does “core” and “non-core” mean?

- Box D: Fiscal gimmickry strikes back

- Box E: Are health pressures predictable?

- Box F: What is happening Ireland’s corporation taxes?

- Box G: Ireland’s green transition can be managed

- Box H: The Future Ireland Fund

- Box I: The Infrastructure, Climate and Nature Fund

- Box J: The latest developments towards EU fiscal rules reform

Supporting Information sections

You can read the Minister for Finance’s response to the report here

Response of the Minister for Finance to the Fiscal Assessment Report, December 2023

Summary Assessment

The Irish economy remains strong. Economic activity has broadly recovered, and the jobs market is exceptionally tight. This is despite numerous pressures: high prices, the rise in interest rates and international risks. The economy looks to have been performing above its normal capacity. As such, prices are at risk of staying higher for longer. This is clearly not a time to add too much stimulus to the economy.

With Budget 2024, the Government opted to introduce another large, untargeted budget package. The budget package in total was about €12 billion (3.9% of GNI*). This puts it in line with other post-Covid budget packages. The package is substantial. It is about three times larger than pre-Covid budget packages, which typically amounted to €3 to 4 billion.

Cost of living supports will help many but were largely untargeted. Less than one-third of the cost of living supports introduced by the Government in Budget 2024 were targeted. Universal energy credits and child benefit payments featured once more. A smaller package of targeted measures could have supported those most vulnerable at less cost. The lack of targeting is also unhelpful for dampening price pressures.

This Budget will add to price pressures in the economy. Instead of prioritising areas most in need, the Government opted to raise current spending, ramp up capital spending, cut income taxes, and introduce another substantial package of cost of living supports. This “everything now” approach repeats mistakes of the past of using temporarily strong tax receipts to expand the budget quickly. If the National Spending Rule and the Council’s recommendations to dispense with temporary supports were followed, it would have meant consumer price inflation in 2024 closer to an estimated 2.2% rather than 2.9%. The larger package risks keeping inflation higher for longer. And new evidence in this report suggests that the tax cuts could fuel price pressures by more again.

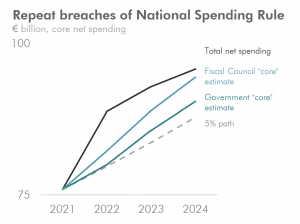

Taking the budget figures at face value, the Government looks set to repeatedly breach the National Spending Rule. The pace of expansion in terms of spending increases and tax cuts is about 5.8% in 2024. This compares to the Rule’s 5% limit. Since the Rule was introduced in 2021, the level of budgetary measures is cumulatively €6.6 billion (7.5%) above what would be implied by a 5% path.

The Government employed fiscal gimmickry to flatter its numbers. Measures introduced in Budget 2024 lacked transparency. The Government used many techniques to present lower spending than is likely. Many of the measures labelled as “non-core” or presented as one-off in nature look likely to persist beyond 2024. This includes the Ukrainian supports and Covid spending in health. Some of the cost-of-living measures introduced, such as mortgage interest relief, also look likely to stick around. A widely anticipated health overrun for 2023 was ignored in the budget figures. And a new category of capital spending labelled “windfall capital investment” is clearly just additional capital spending but was treated as outside of both “core” and “non-core” spending.

These deliberate attempts to game fiscal assessments are deeply concerning. Gimmicks like this tend to crop up when governments want to make budgetary figures look more favourable than they really are. The National Spending Rule’s focus on core spending is also likely to have prompted this. The Government should not continue this gimmickry.

The reality is that pressures to spend more will be substantial. The Council estimates that “Stand-Still” costs are far higher than is allowed for in official projections. These are the costs of providing existing public services, given an older and growing population and higher prices. The pressures in health are particularly acute. The Budget ignored this year’s health overruns and the health allocation for 2024 was barely sufficient to cover Stand-Still costs. The pressures in these areas are largely predictable and should not come as a surprise. They follow the ageing of the population and the tendency for prices to rise faster in healthcare. Not dealing with them head on risks further overruns in future.

Notwithstanding that, revenues also face upside risks and the immediate debt path looks sustainable. Revenues could prove stronger than forecast in Budget 2024. While there have been concerns around corporation tax receipts falling of late, and there are risks around how long they will remain strong, there are several reasons windfalls could continue to grow in the near term.

The Future Ireland Fund is an important milestone. While the Council is highly critical of many aspects of Budget 2024, the development of the Future Ireland Fund is something it strongly welcomes. The Fund puts risky corporation tax receipts to good use and has the potential to grow substantially. This should lessen the need for higher taxes or deep spending cuts on future generations. Our simulations suggest that the Fund could potentially offset more than half of Ireland’s ageing costs in 2041 and a quarter by 2050.

Committing to the National Spending Rule is key. The Government has not shown its commitment to the spirit of the National Spending Rule. Official plans show repeated breaches, and gimmicks are being used to hide the extent of these. Ireland’s public finances are unlikely to be guided by EU fiscal rules in future. This means the National Spending Rule will be key to helping guide the public finances through major challenges such as the climate transition and the rapid ageing of Ireland’s population. It can also help ensure that the Government is able to support the economy through future downturns rather than raising taxes and cutting spending, as it did during the austerity period. To ensure this, the Rule needs to be reinforced and, most importantly, adhered to.