This is one of the Council’s main reports. Two such reports are published each year.

This report assesses the Government’s Annual Progress Report. It looks at the economic environment, the overall fiscal stance, the forecasts, and how it complies with fiscal rules.

Report

Additional materials

- Data Pack

- Press Release

- Briefing Presentation

- Supporting items (additional analysis)

- Endorsement note

The Minister’s response

Response of the Minister for Finance to the Fiscal Assessment Report, June 2025

Summary

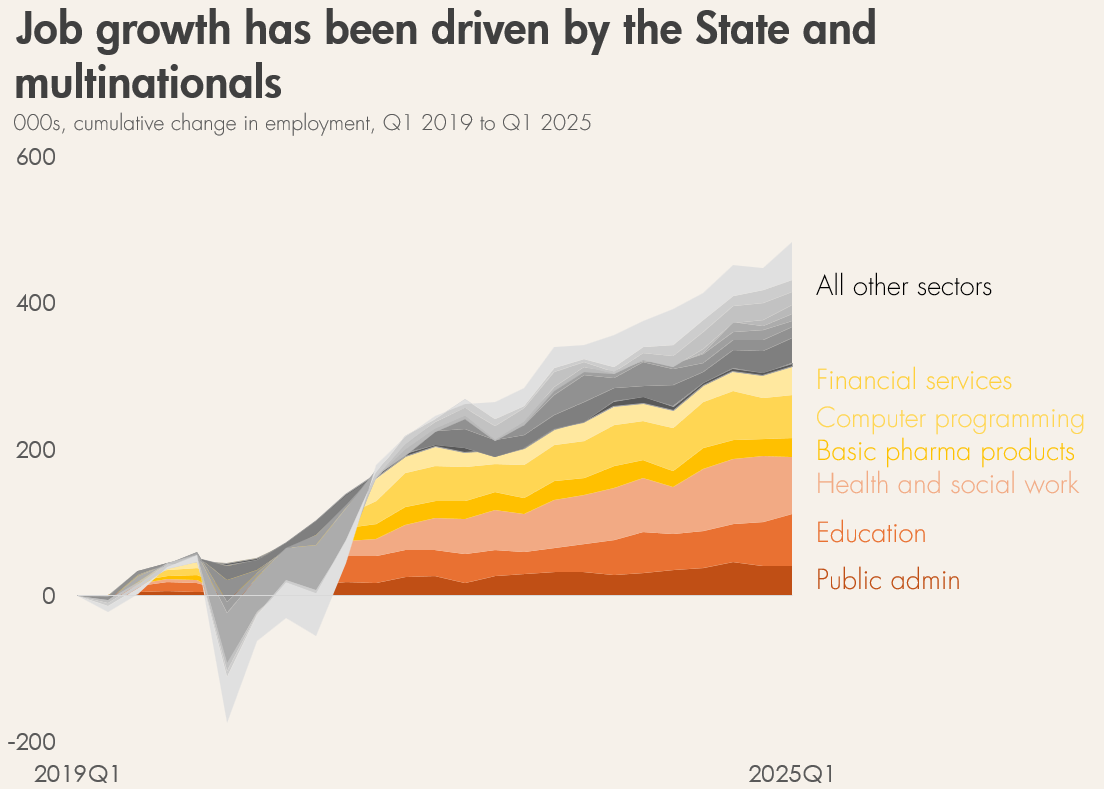

The Irish economy is in a strong position. Since 2019, employment has increased by almost 500,000. These increases in employment have been driven by multinationals and the State.

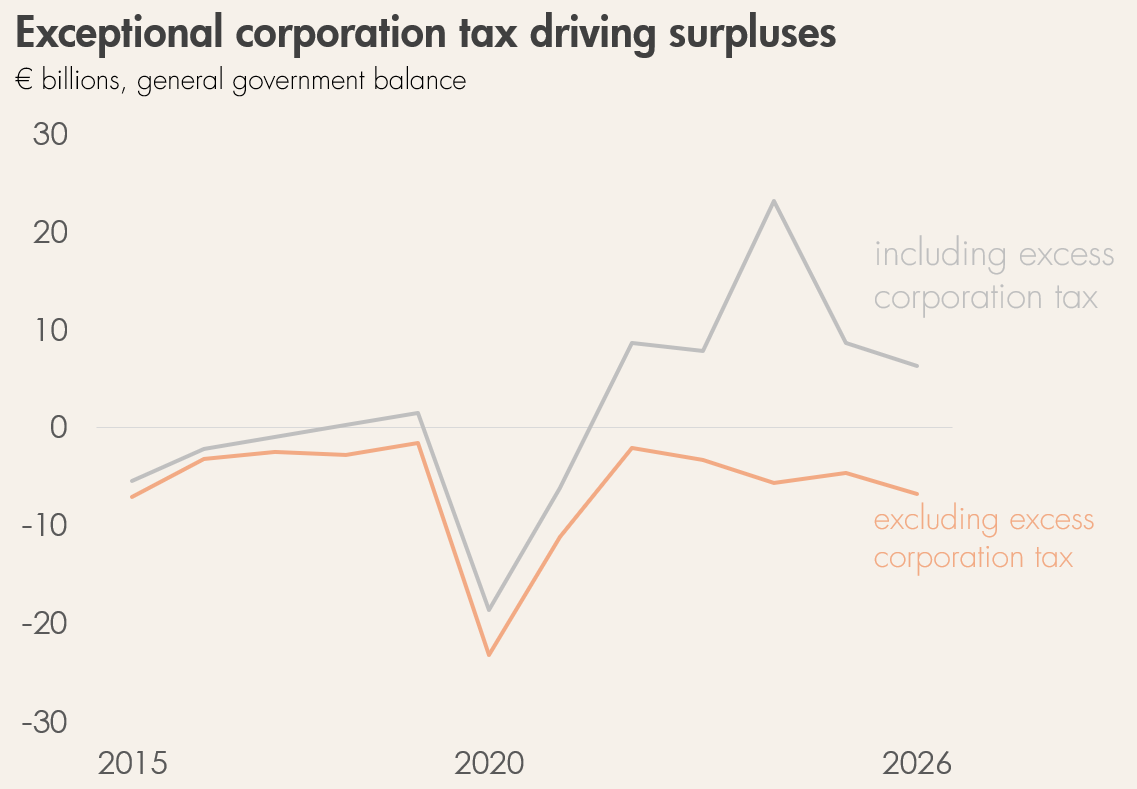

The government budget is in surplus. But this is purely due to remarkable levels of corporation tax being collected. These receipts may well increase, but they remain high risk. US firms account for three-quarters of corporation tax receipts.

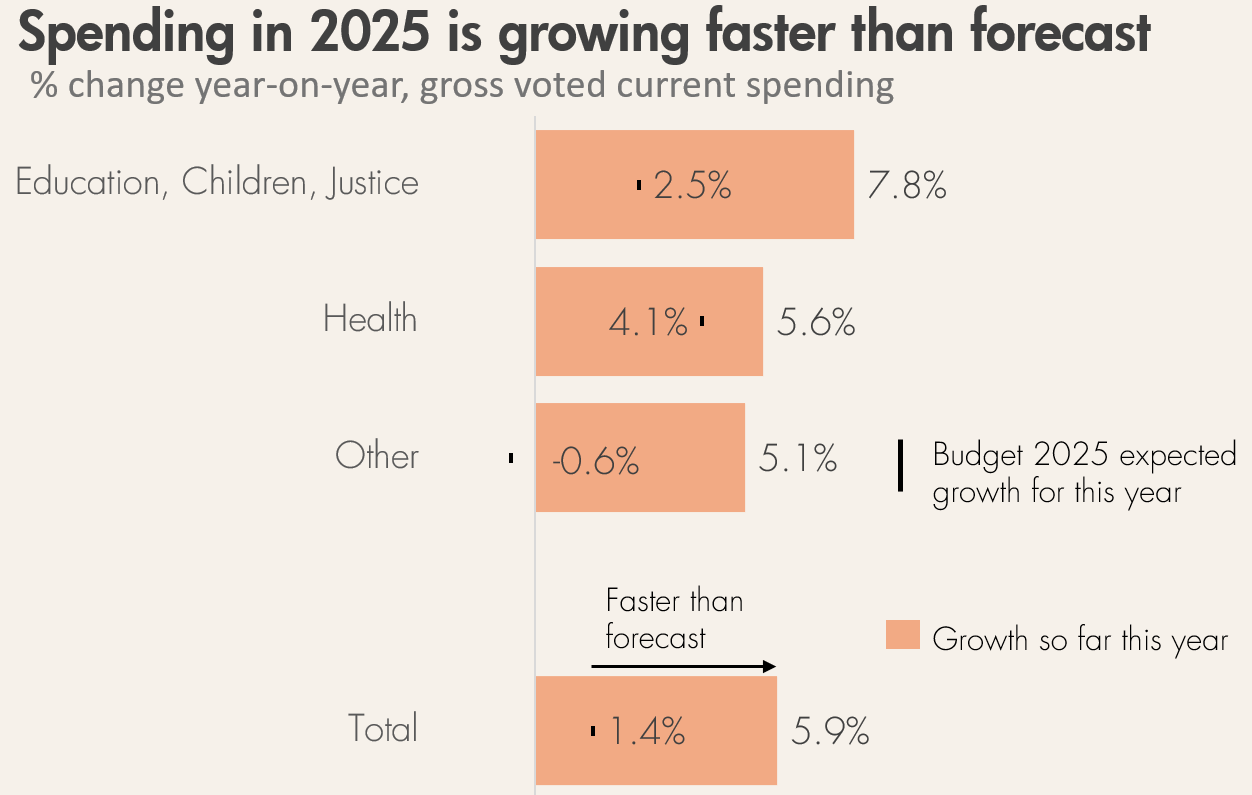

Spending is growing at a much faster pace than Budget 2025 allowed for. This is occurring in most areas of spending, not just health. At the current pace of growth, overruns of €2 billion are likely.

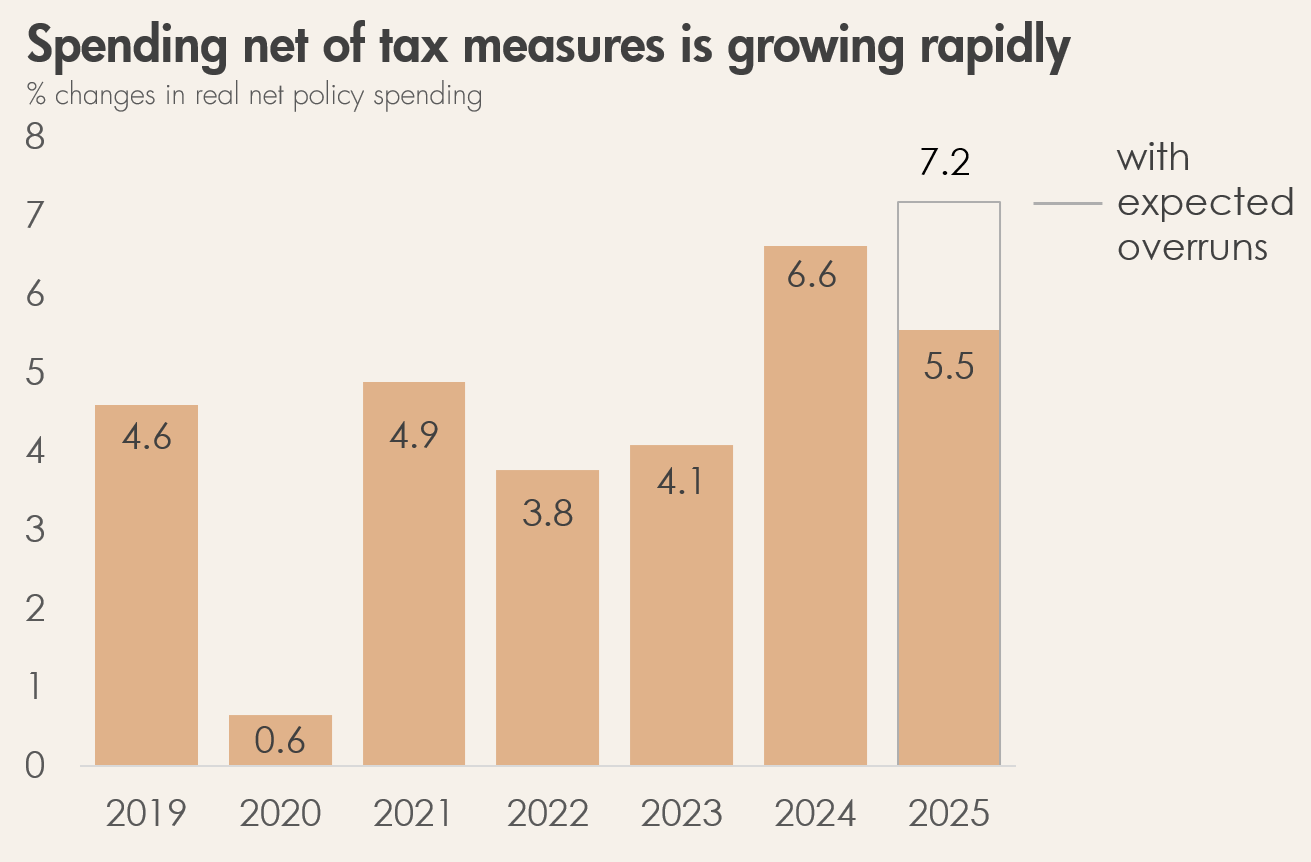

The government has been increasing spending net of tax measures at a rapid rate. Even after adjusting for inflation, net spending has been increasing at a fast pace in recent years. This comes at a time where the economy was strong and didn’t require support from the government.

The Government should:

1 ) Commit to a fiscal rule. This would set a sustainable growth rate for spending net of tax changes.

2) Use budgetary policy to reduce the ups and downs of the economic cycle.

3 ) Focus on infrastructure and competitiveness. No matter how the economy evolves, Ireland needs to address shortages of key infrastructure.

4) Set realistic spending forecasts. Recent forecasts have ignored previous overruns.