This is the Council’s main biannual report, the Fiscal Assessment Report.

The report assesses the Government’s SPU 2024 in terms of: the broad fiscal stance, the economic and budgetary forecasts, and Ireland’s compliance with fiscal rules.

- Fiscal Assessment Report, June 2024 (full report)

- Summary Assessment

- Data Pack

- Press Release

- Briefing Presentation

Boxes

-

- Box A: Where will additional construction workers come from?

- Box B: How narrow is Ireland’s tax base

- Box C: Potential windfalls from Data Protection fines

- Box D: Reinforcing the National Spending Rule

- Box E: What rate should the National Spending Rule be set at?

- Box F: Substantial EU fiscal rule reforms come into place

Supporting Information sections

You can read the Minister for Finance’s response to the report here

Response of the Minister for Finance to the Fiscal Assessment Report, June 2024

Summary Assessment

The Irish economy remains strong, operating at or above potential. While economic growth has moderated somewhat, the jobs market remains very tight, with record high employment and historically low unemployment. Inflation is moderating, due to falling energy prices, but underlying inflation remains relatively high. The Council assesses the economy to be operating at or above capacity. There is a risk of the economy overheating.

Against this backdrop, pursuing loose budgetary policy would make overheating more likely to occur. Despite favourable economic conditions, the Government’s underlying balance is projected to remain in deficit for the next 3 years. Excluding excess corporation tax receipts, a deficit of €2.7 billion (0.9% GNI*) is forecast for this year. This comes despite a strong economy, with record high employment and historically low unemployment. The question arises: if underlying surpluses are not being run now that the economy is strong, when would they be run?

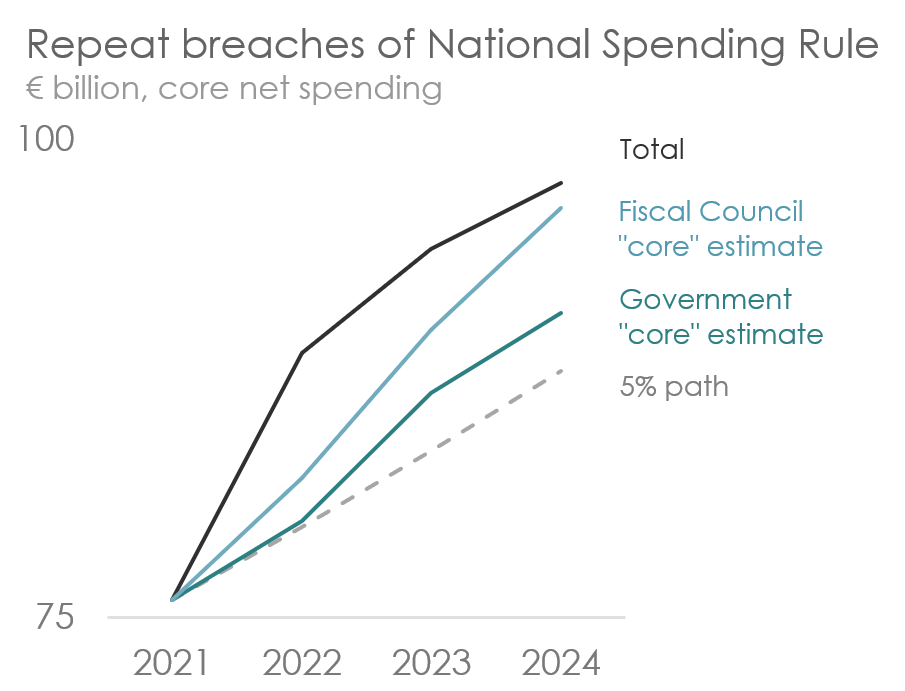

The Government looks set to repeatedly breach the National Spending Rule. Net spending is set to increase by more than 5% this year and next year. Since the rule was introduced in 2021, the level of budgetary measures by 2024 is cumulatively €8.5 billion (9.7%) above what would be implied by a 5% path.

Our assessment of the breach is larger than that shown in SPU 2024. This is because we account for likely spending overruns and fiscal gimmickry.

• Overruns in health spending are still not reflected in SPU 2024 spending forecasts. Health spending overruns in 2023 were not incorporated into Budget 2024 forecasts. This year, spending overruns are materialising earlier in the year than normal and are at a higher level than previously. Health spending overruns have been commonplace for over a decade.

• The Council welcomes spending on health related to Covid-19 and spending on humanitarian assistance for Ukrainian refugees being included in spending forecasts beyond this year. This contrasts with Budget 2024, when this spending was assumed to fall to zero in 2025. However, this spending is likely to be long-lasting. Hence, it should be included in core spending. The continued use of fiscal gimmickry— the use of creative accounting techniques to make a government’s fiscal numbers adhere to fiscal rules or look more favourable than they are—is undesirable as it weakens transparency.

Government revenue is highly concentrated and hence could reverse suddenly. Risks around corporation tax are well known, with estimates suggesting 3 firms contributed 43% of corporation tax in 2022. Income tax is also heavily concentrated. A small number of employees pay a large share of income tax. These highly paid employees are likely to work in highly profitable sectors where large corporation tax payments are made. A downturn in these sectors would mean not just a reduction in corporation tax, but also income tax.

Therefore, the Council is of the view that current budgetary policy is not conducive to prudent economic and budgetary management. Given the favourable position of the economy, this is not a time for fiscal stimulus. Despite this, a large Budgetary package was introduced for this year. SPU 2024 indicates another sizeable increase in net spending is planned for next year.

As is always the case, there are several seemingly compelling demands for public spending and tax cuts.

• The costs of maintaining existing levels of services exceeds current spending allocations. Our estimates suggest that the SPU forecasts of current spending increases are on average €0.7 billion lower than annual stand-still costs in 2025, 2026 and 2027. An ageing population means significant costs to maintain existing levels of service.

• Given some of the evident infrastructure shortfalls, it is tempting to increase public capital spending to address these. Given the strong position of the economy and the tight labour market, getting value for money on public investment could be challenging.

• In addition, addressing infrastructure deficits while the jobs market is tight will be challenging. Attracting construction workers to work on these projects looks to be more difficult than it was in the early 2000s.

However, choices must be made. Spending pressures are likely to be much stronger than SPU forecasts indicate. But this is not a time for the ‘everything now’ approach of tax cuts, increases in current spending and ramping up capital spending all at once. As the spending rule is defined in net terms, spending increases greater than 5% would call for sustainable revenue-raising measures. Not indexing the tax system would be one way of raising revenue for larger spending increases.

Against this background, committing to a credible fiscal framework is key. So far, the Government’s commitment to the National Spending Rule has been weak, with repeated breaches and fiscal gimmickry used to hide the extent of the breaches.

The new EU fiscal rules bring a welcome medium-term focus to budgeting. Under the new rules, the government will submit a medium-term (5 year) plan. This plan will limit the growth in net expenditure each year, beginning in 2025.

However, the new EU fiscal rules will not be a good guide for Ireland’s budgetary policy. The new rules will continue to be assessed on a GDP basis and they will not account for excess corporation tax receipts. Therefore, the health of Ireland’s public finances will be overstated, meaning the new EU rules are unlikely to bind. A positive assessment from the European Commission based on EU rules is of little value given how inappropriate the rules are for Ireland.

Hence the need to strengthen the domestic fiscal framework. Tying medium-term net spending to a sustainable growth rate of the economy is desirable. An anchor for budgetary policy helps to guide Ireland away from boom-bust budgetary policies of the past.

Budgetary projections should be improved. Budgetary projections in SPU 2024 only go three years ahead. Forecasts should be produced at least five years ahead to give a medium-term orientation to budgetary policy. The full impact of fiscal costs that are inevitable in the coming years should be factored in. SPU 2024 projections do not incorporate the likely costs of climate change and Sláintecare. Budgetary forecasts should be focused on general government terms, which is the relevant fiscal aggregate at the EU level. Transparency needs to be enhanced, especially for non-Exchequer areas of spending.

The National Spending Rule should be further strengthened. The National Spending Rule should be widened to cover all general government, include adjustments for cyclical unemployment spending and appropriate escape clauses should be created. Placing the National Spending Rule on a legislative basis would strengthen the rule and make it more likely to be complied with.

The establishment of the Future Ireland Fund is welcome but it should not be viewed as a substitute for complying with the National Spending Rule. The Council welcomes the establishment of the Future Ireland Fund. However, the Council believes the Government should be more ambitious and set aside all windfall corporation tax receipts into the savings funds. This would leave Ireland better placed to withstand the costs arising from an ageing population and climate change. Saving into such funds is a complement to, not a substitute for, complying with the National Spending Rule. Running a budgetary policy which is too loose when the economy is operating at or over full capacity is bad practice. This is the case regardless of what contributions are being made to savings funds.