This page provides up-to-date information on monthly cash receipts received by the government.

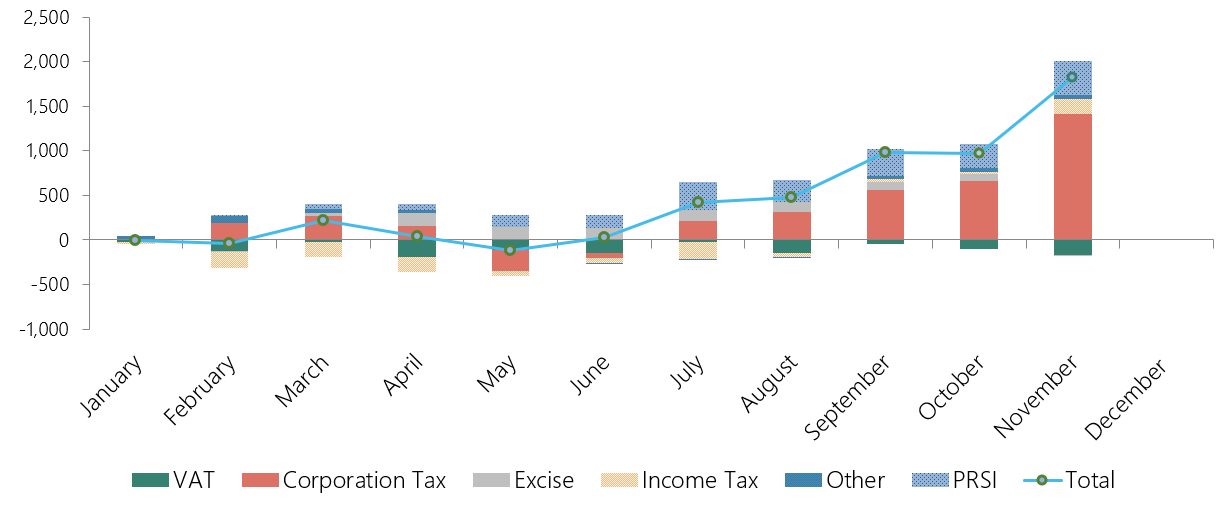

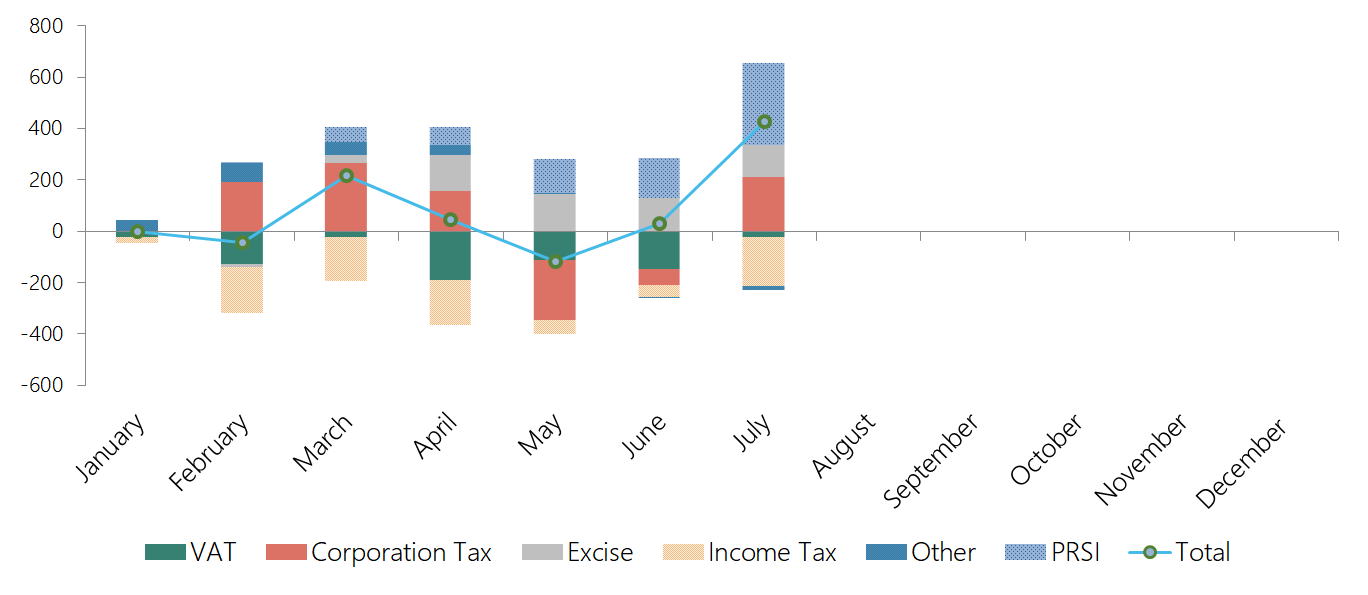

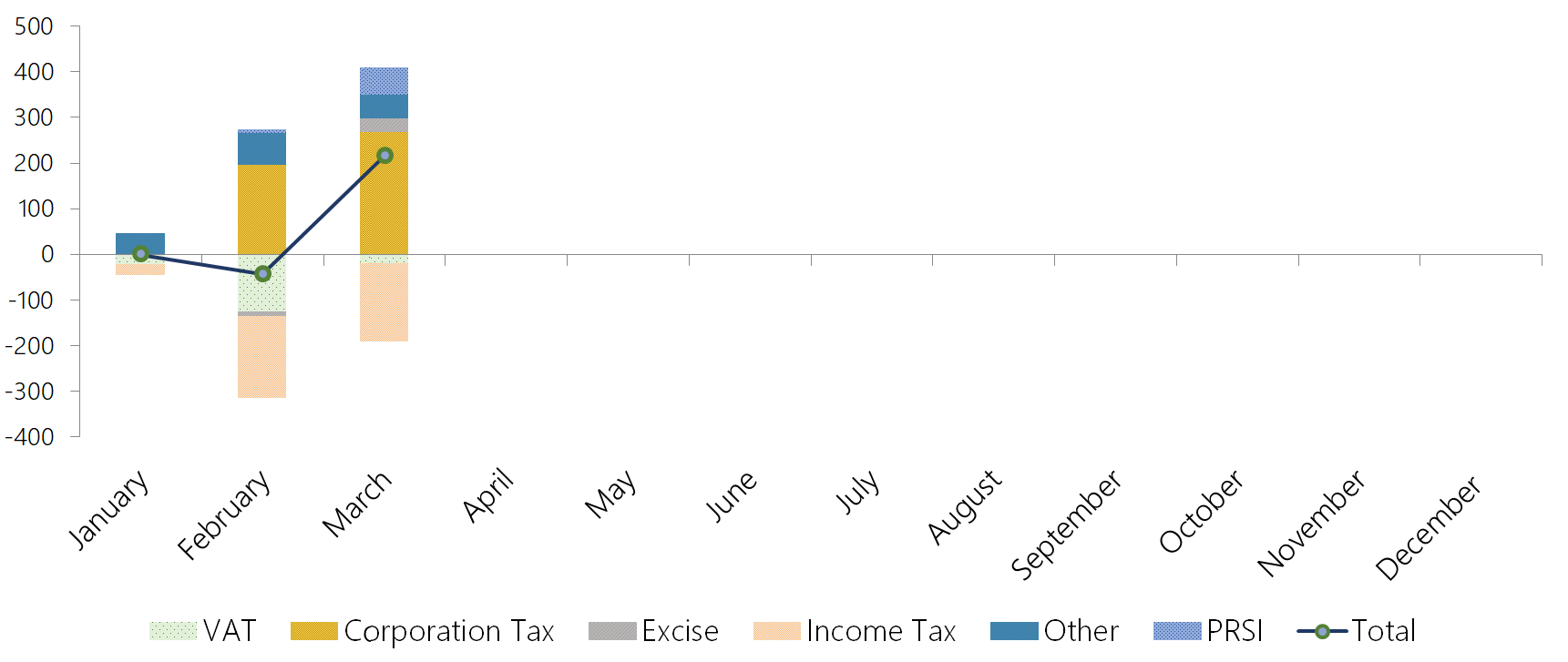

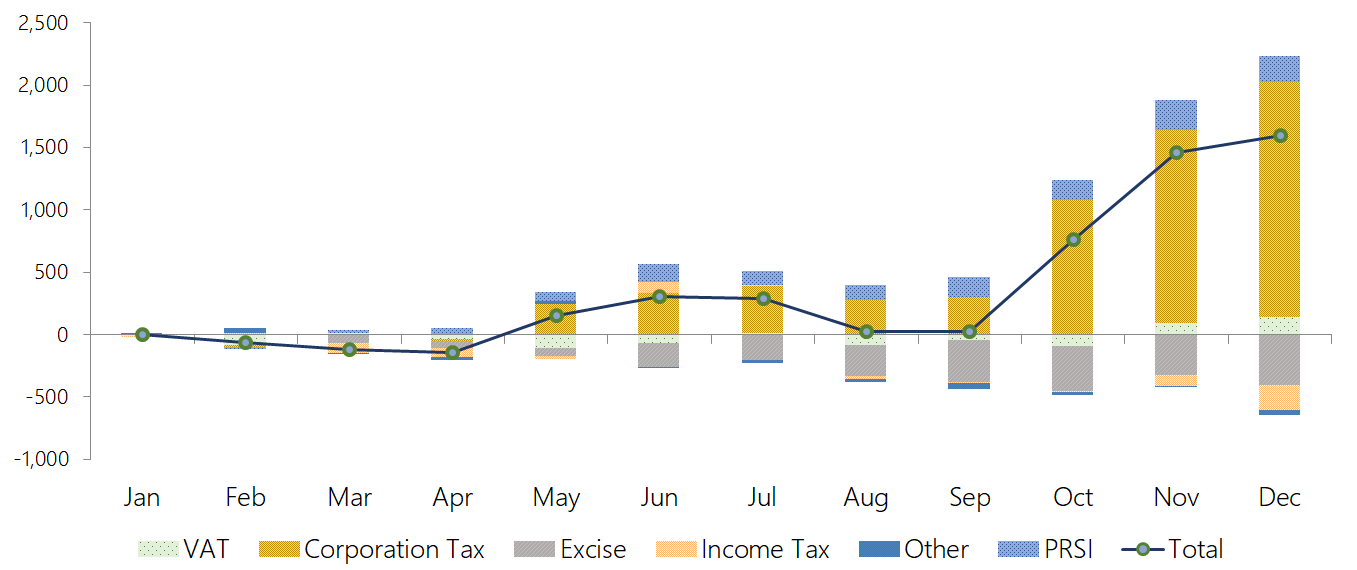

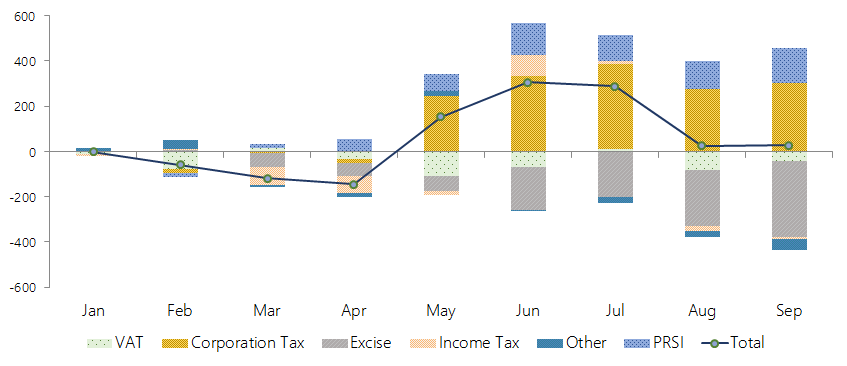

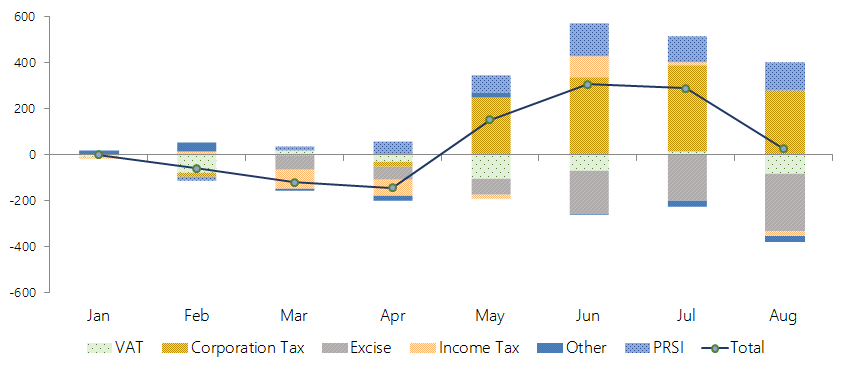

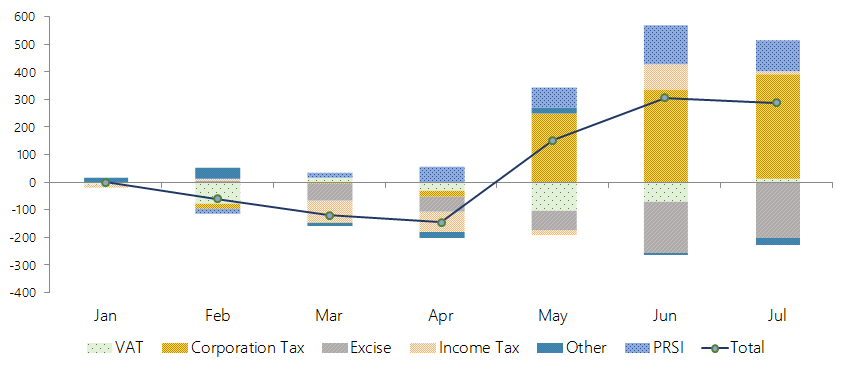

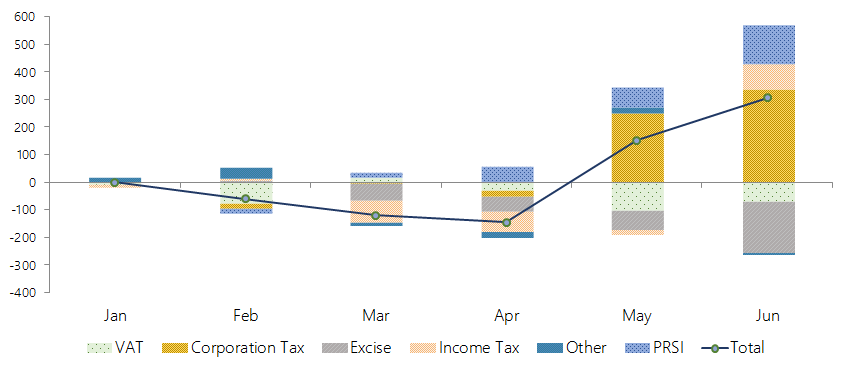

2019

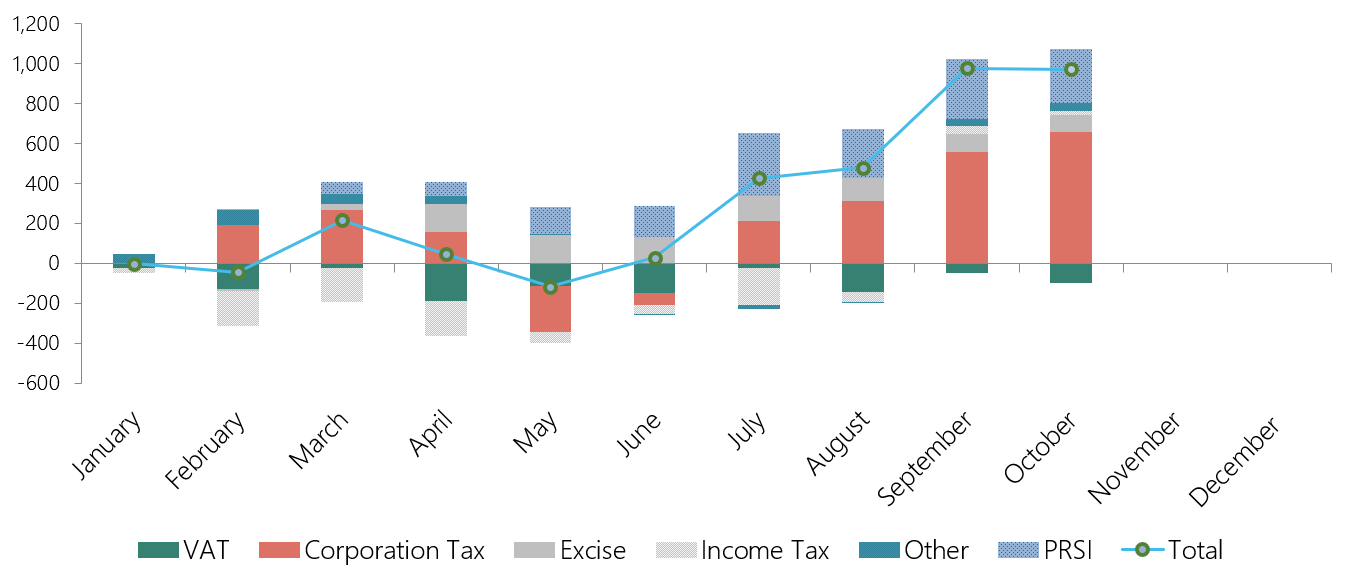

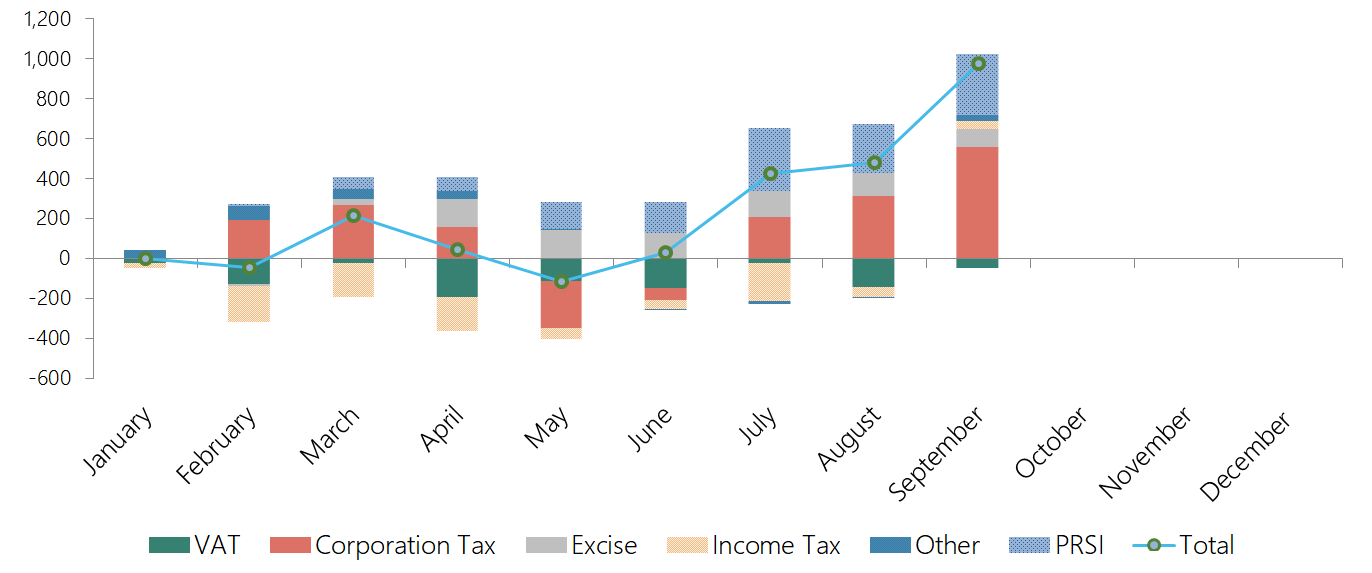

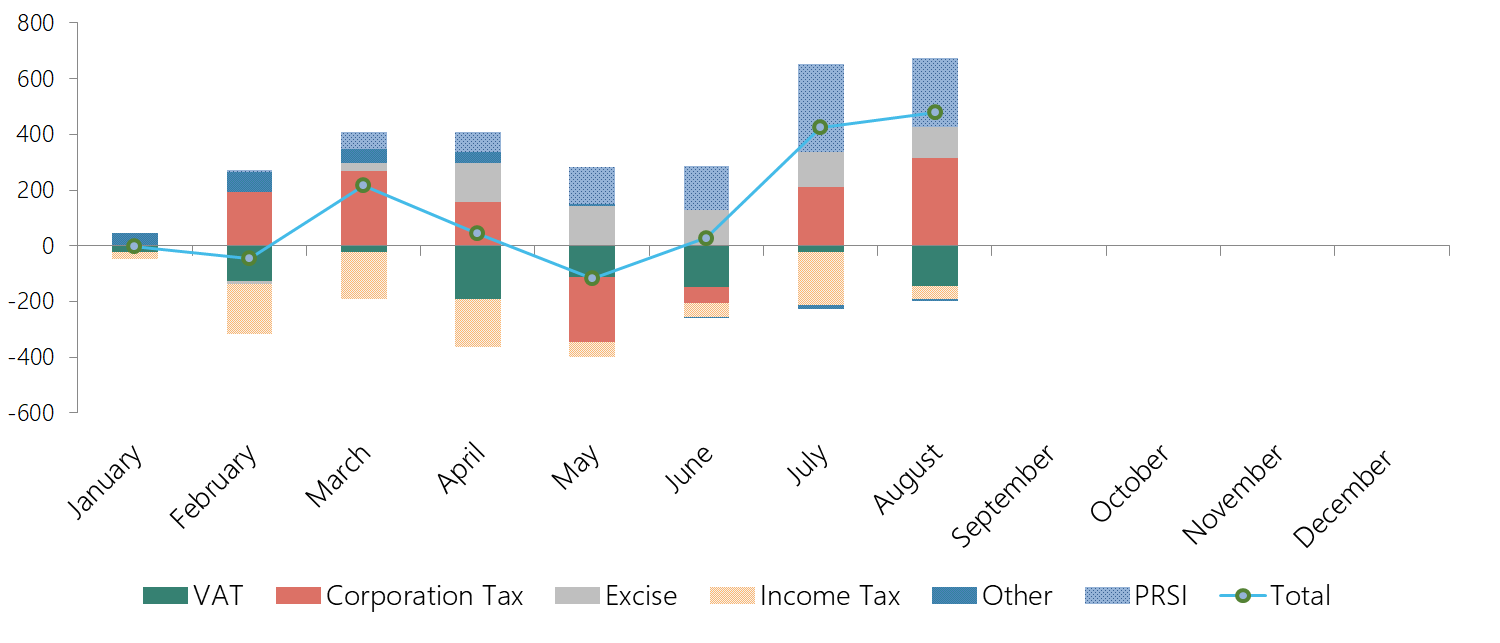

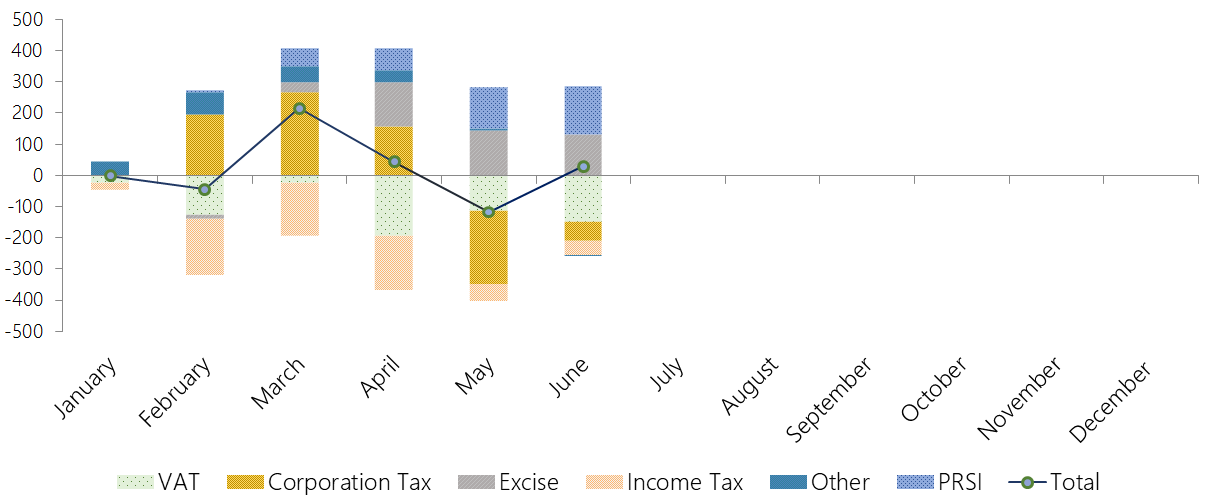

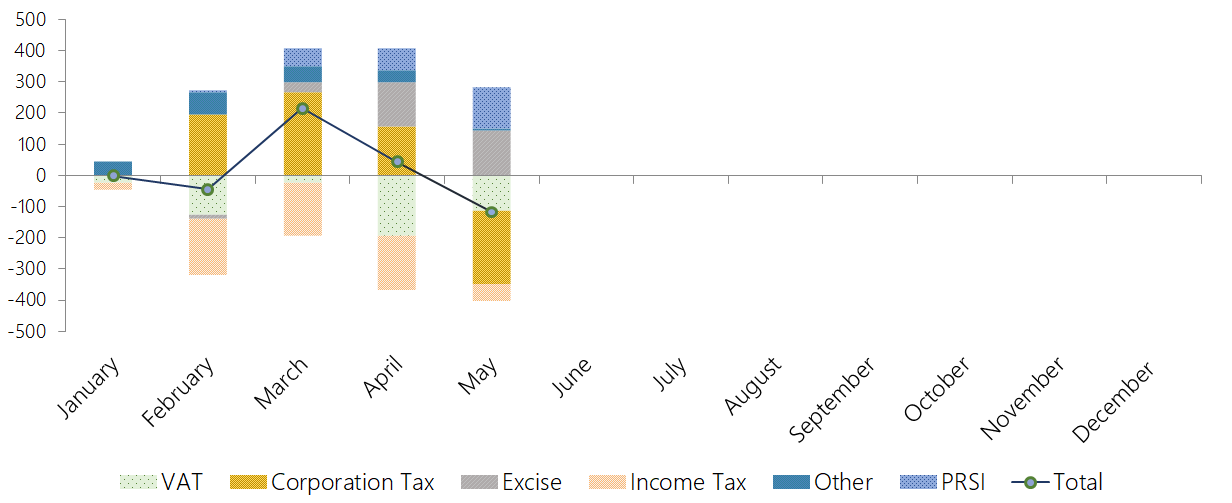

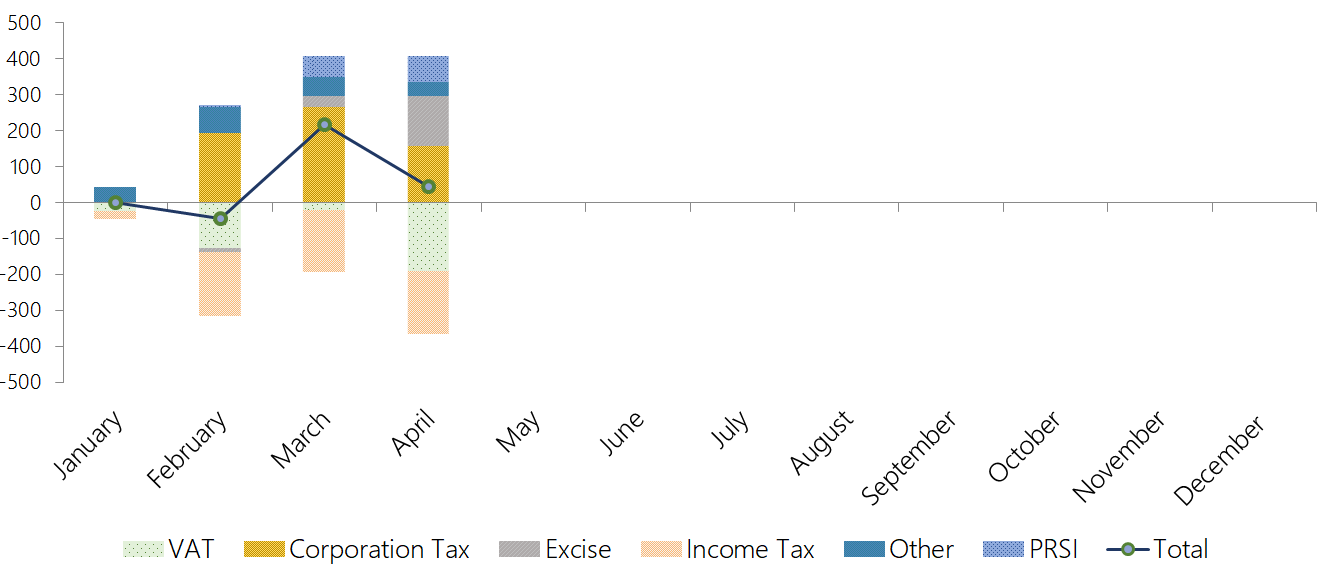

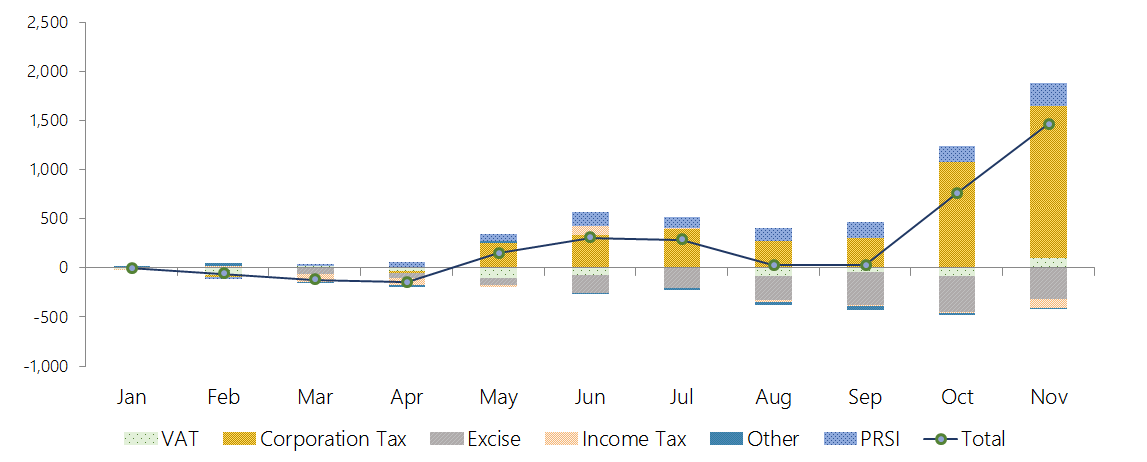

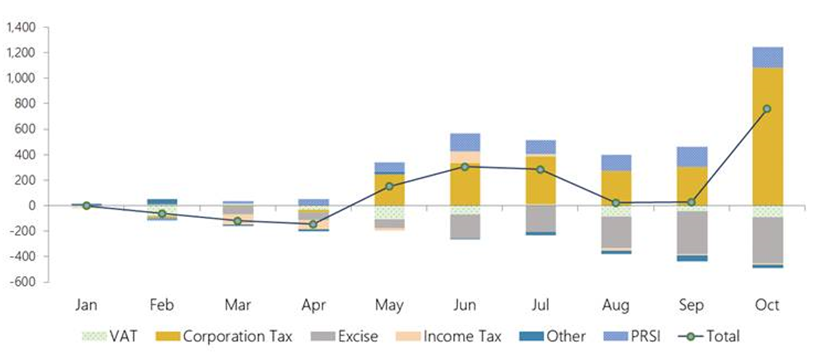

2018

Exchequer Returns: End-November 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 54,890 | 53,444 | 1,446 | 2.7 |

| Income Tax | 21,119 | 20,944 | 175 | 0.8 |

| VAT | 14,840 | 15,011 | -171 | -1.1 |

| Corporation Tax | 10,008 | 8,600 | 1,408 | 16.4 |

| Excise Duty | 5,351 | 5,364 | -13 | -0.2 |

| Other Taxes | 3,572 | 3,525 | 47 | 1.3 |

| PRSI Receipts | 10,529 | 10,153 | 376 | 3.7 |

| Other Revenue | 4,603 | 4,231 | 372 | 8.8 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 70,022 | 67,828 | 2,194 | 3.2 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-October 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 44,973 | 44,267 | 706 | 1.6 |

| Income Tax | 17,589 | 17,565 | 24 | 0.1 |

| VAT | 12,553 | 12,652 | -99 | -0.8 |

| Corporation Tax | 6,885 | 6,225 | 660 | 10.6 |

| Excise Duty | 4,895 | 4,814 | 81 | 1.7 |

| Other Taxes | 3,051 | 3,011 | 40 | 1.3 |

| PRSI Receipts | 9,290 | 9,023 | 267 | 3.0 |

| Other Revenue | 3,946 | 3,631 | 315 | 8.7 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 58,209 | 56,922 | 1,287 | 2.3 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-September 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 40,782 | 40,107 | 675 | 1.7 |

| Income Tax | 15,752 | 15,711 | 41 | 0.3 |

| VAT | 12,313 | 12,359 | -46 | -0.4 |

| Corporation Tax | 5,839 | 5,281 | 558 | 10.6 |

| Excise Duty | 4,365 | 4,276 | 89 | 2.1 |

| Other Taxes | 2,513 | 2,480 | 33 | 1.3 |

| PRSI Receipts | 8,383 | 8,080 | 303 | 3.7 |

| Other Revenue | 3,610 | 3,324 | 286 | 8.6 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 52,775 | 51,512 | 1,263 | 2.5 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-August 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 35,048 | 34,818 | 230 | 0.7 |

| Income Tax | 14,080 | 14,128 | -48 | -0.3 |

| VAT | 9,901 | 10,045 | -144 | -1.4 |

| Corporation Tax | 4,928 | 4,614 | 314 | 6.8 |

| Excise Duty | 3,916 | 3,803 | 113 | 3.0 |

| Other Taxes | 2,223 | 2,228 | -5 | -0.2 |

| PRSI Receipts | 7,459 | 7,211 | 248 | 3.4 |

| Other Revenue | 3,250 | 3,050 | 200 | 6.6 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 45,757 | 45,079 | 678 | 1.5 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-July 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 31,944 | 31,834 | 110 | 0.3 |

| Income Tax | 12,219 | 12,408 | -189 | -1.5 |

| VAT | 9,749 | 9,771 | -22 | -0.2 |

| Corporation Tax | 4,611 | 4,401 | 210 | 4.8 |

| Excise Duty | 3,426 | 3,298 | 128 | 3.9 |

| Other Taxes | 1,939 | 1,956 | -17 | -0.9 |

| PRSI Receipts | 6,685 | 6,369 | 316 | 5.0 |

| Other Revenue | 2,931 | 2,788 | 143 | 5.1 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 41,560 | 40,991 | 569 | 1.4 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-June 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 26,672 | 26,799 | -127 | -0.5 |

| Income Tax | 10,492 | 10,539 | -47 | -0.4 |

| VAT | 7,446 | 7,594 | -148 | -1.9 |

| Corporation Tax | 4,174 | 4,233 | -59 | -1.4 |

| Excise Duty | 2,921 | 2,791 | 130 | 4.7 |

| Other Taxes | 1,639 | 1,642 | -3 | -0.2 |

| PRSI Receipts | 5,590 | 5,435 | 155 | 2.9 |

| Other Revenue | 2,661 | 2,478 | 183 | 7.4 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 34,923 | 34,712 | 211 | 0.6 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

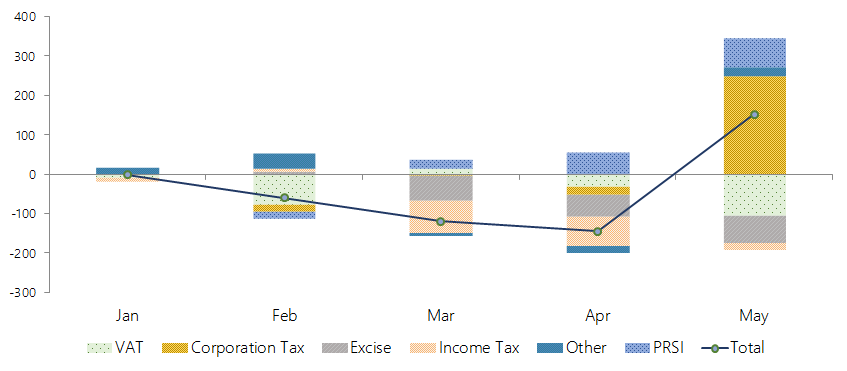

Exchequer Returns: End-May 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 21,711 | 21,962 | -251 | -1.1 |

| Income Tax | 8,725 | 8,780 | -55 | -0.6 |

| VAT | 7,308 | 7,420 | -112 | -1.5 |

| Corporation Tax | 1,807 | 2,040 | -233 | -11.4 |

| Excise Duty | 2,448 | 2,304 | 144 | 6.3 |

| Other Taxes | 1,423 | 1,418 | 5 | 0.4 |

| PRSI Receipts | 4,703 | 4,570 | 133 | 2.9 |

| Other Revenue | 2,270 | 2,083 | 187 | 9.0 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 28,684 | 28,614 | 70 | 0.2 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-April 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 15,570 | 15,597 | -27 | -0.17 |

| Income Tax | 6,965 | 7,138 | -173 | -2.4 |

| VAT | 4,992 | 5,183 | -191 | -3.7 |

| Corporation Tax | 468 | 311 | 157 | 50.5 |

| Excise Duty | 1,967 | 1,826 | 141 | 7.7 |

| Other Taxes | 1,178 | 1,139 | 39 | 3.4 |

| PRSI Receipts | 3,777 | 3,706 | 71.3 | 1.9 |

| Other Revenue | 1,302 | 1,280 | 22.3 | 1.7 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 20,649 | 20,582 | 66.5 | 0.3 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-March 2019 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 12,795 | 12,638 | 157 | 1.2 |

| Income Tax | 4,973 | 5,144 | -171 | -3.3 |

| VAT | 4,986 | 5,007 | -21 | -0.4 |

| Corporation Tax | 524 | 257 | 267 | 103.9 |

| Excise Duty | 1,375 | 1,345 | 30 | 2.2 |

| Other Taxes | 937 | 885 | 52 | 5.9 |

| PRSI Receipts | 2,755 | 2,696 | 59 | 2.2 |

| Other Revenue | 957 | 964 | -7 | -0.7 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 16,507 | 16,298 | 209 | 1.3 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax Receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-December 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 55,558 | 54,175 | 1,383 | 2.6 |

| Income Tax | 21,242 | 21,445 | -203 | -0.9 |

| VAT | 14,234 | 14,090 | 144 | 1.0 |

| Corporation Tax | 10,385 | 8,505 | 1,880 | 22.1 |

| Excise Duty | 5,418 | 5,820 | -402 | -6.9 |

| Other Taxes | 4,279 | 4,315 | -36 | -0.8 |

| PRSI Receipts | 10,457 | 10,244 | 213 | 2.1 |

| Other Revenue | 4,974 | 4,344 | 630 | 14.5 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 70,989 | 68,763 | 2,226 | 3.2 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other Taxes include Stamps, Capital Taxes, Motor Tax and Other Unallocated Tax Receipts. Other Revenue includes the National Training Fund, Other A-in-As, Non-Tax Revenue, and Capital Resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-November 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 51,435 | 50,212 | 1,223 | 2.4 |

| Income Tax | 19,455 | 19,547 | -92 | -0.5 |

| VAT | 14,080 | 13,986 | 94 | 0.7 |

| Corporation Tax | 9,446 | 7,898 | 1,548 | 19.6 |

| Excise Duty | 4,997 | 5,316 | -319 | -6.0 |

| Other Taxes | 3,457 | 3,465 | -8 | -0.2 |

| PRSI Receipts | 9,611 | 9,371 | 240 | 2.6 |

| Other Revenue | 4,031 | 3,863 | 168 | 4.3 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 65,077 | 63,446 | 1,631 | 2.6 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other taxes include stamps, capital taxes, motor tax, customs and other unallocated tax receipts. Other revenue includes the National Training Fund, other A-in-As, non-tax Revenue, and capital resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-October 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 42,165 | 41,569 | 596 | 1.4 |

| Income Tax | 16,268 | 16,278 | -10 | -0.1 |

| VAT | 11,811 | 11,900 | -89 | -0.7 |

| Corporation Tax | 6,738 | 5,658 | 1,080 | 19.1 |

| Excise Duty | 4,419 | 4,780 | -361 | -7.6 |

| Other Taxes | 2,929 | 2,953 | -24 | -0.8 |

| PRSI Receipts | 8,507 | 8,344 | 163 | 2.0 |

| Other Revenue | 3,632 | 3,285 | 347 | 10.6 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 54,304 | 53,198 | 1,106 | 2.1 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other Taxes include Stamps, Capital Taxes, Motor Tax and Other Unallocated Tax Receipts. Other Revenue includes the National Training Fund, Other A-in-As, Non-Tax Revenue, and Capital Resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-September 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 37,529 | 37,656 | -127 | -0.3 |

| ↳ Income Tax | 14,535 | 14,542 | -7 | -0.1 |

| ↳ VAT | 11,571 | 11,610 | -39 | -0.3 |

| ↳ Corporation Tax | 5,159 | 4,853 | 306 | 6.3 |

| ↳ Excise Duty | 3,879 | 4,218 | -339 | -8.0 |

| ↳ Other Taxes | 2,385 | 2,433 | -48 | -2.0 |

| PRSI Receipts | 7,621 | 7,466 | 155 | 2.1 |

| Other Revenue | 3,272 | 3,008 | 264 | 8.8 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 48,422 | 48,130 | 292 | 0.6 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other Taxes include Stamps, Capital Taxes, Motor Tax and Other Unallocated Tax Receipts. Other Revenue includes the National Training Fund, Other A-in-As, Non-Tax Revenue, and Capital Resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-August 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 32,422 | 32,523 | -101 | -0.3 |

| ↳ Income Tax | 13,051 | 13,072 | -21 | -0.2 |

| ↳ VAT | 9,382 | 9,463 | -81 | -0.9 |

| ↳ Corporation Tax | 4,366 | 4,090 | 276 | 6.7 |

| ↳ Excise Duty | 3,475 | 3,724 | -249 | -6.7 |

| ↳ Other Taxes | 2,148 | 2,174 | -26 | -1.2 |

| PRSI Receipts | 6,798 | 6,673 | 125 | 1.9 |

| Other Revenue | 3,046 | 2,768 | 278 | 10.0 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 42,266 | 41,964 | 302 | 0.7 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other Taxes include Stamps, Capital Taxes, Motor Tax and Other Unallocated Tax Receipts. Other Revenue includes the National Training Fund, Other A-in-As, Non-Tax Revenue, and Capital Resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-July 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 29,690 | 29,515 | 175 | 0.6 |

| ↳ Income Tax | 11,447 | 11,434 | 13 | 0.1 |

| ↳ VAT | 9,187 | 9,176 | 11 | 0.1 |

| ↳ Corporation Tax | 4,183 | 3,805 | 378 | 9.9 |

| ↳ Excise Duty | 2,997 | 3,199 | -202 | -6.3 |

| ↳ Other Taxes | 1,876 | 1,901 | -25 | -1.3 |

| PRSI Receipts | 6,005 | 5,893 | 112 | 1.9 |

| Other Revenue | 2,705 | 2,516 | 189 | 7.5 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 38,400 | 37,924 | 476 | 1.3 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other Taxes include Stamps, Capital Taxes, Motor Tax and Other Unallocated Tax Receipts. Other Revenue includes the National Training Fund, Other A-in-As, Non-Tax Revenue, and Capital Resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-June 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 24,939 | 24,774 | 165 | 0.7 |

| ↳ Income Tax | 9,743 | 9,651 | 92 | 1.0 |

| ↳ VAT | 7,101 | 7,170 | -69 | -1.0 |

| ↳ Corporation Tax | 4,033 | 3,698 | 335 | 9.1 |

| ↳ Excise Duty | 2,471 | 2,659 | -188 | -7.1 |

| ↳ Other Taxes | 1,591 | 1,596 | -5 | -0.3 |

| PRSI Receipts | 5,124 | 4,983 | 141 | 2.8 |

| Other Revenue | 2,468 | 2,292 | 176 | 7.7 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 32,531 | 32,049 | 482 | 1.5 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other Taxes include Stamps, Capital Taxes, Motor Tax and Other Unallocated Tax Receipts. Other Revenue includes the National Training Fund, Other A-in-As, Non-Tax Revenue, and Capital Resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

Exchequer Returns: End-May 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 20,544 | 20,466 | 78 | 0.4 |

| ↳ Income Tax | 8,090 | 8,109 | -19 | -0.2 |

| ↳ VAT | 6,916 | 7,021 | -105 | -1.5 |

| ↳ Corporation Tax | 2,081 | 1,834 | 247 | 13.5 |

| ↳ Excise Duty | 2,075 | 2,143 | -68 | -3.2 |

| ↳ Other Taxes | 1,382 | 1,359 | 23 | 1.7 |

| PRSI Receipts | 4,304 | 4,230 | 74 | 1.7 |

| Other Revenue | 2,092 | 1,931 | 161 | 8.3 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 26,940 | 26,627 | 313 | 1.2 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other Taxes include Stamps, Capital Taxes, Motor Tax and Other Unallocated Tax Receipts. Other Revenue includes the National Training Fund, Other A-in-As, Non-Tax Revenue, and Capital Resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.

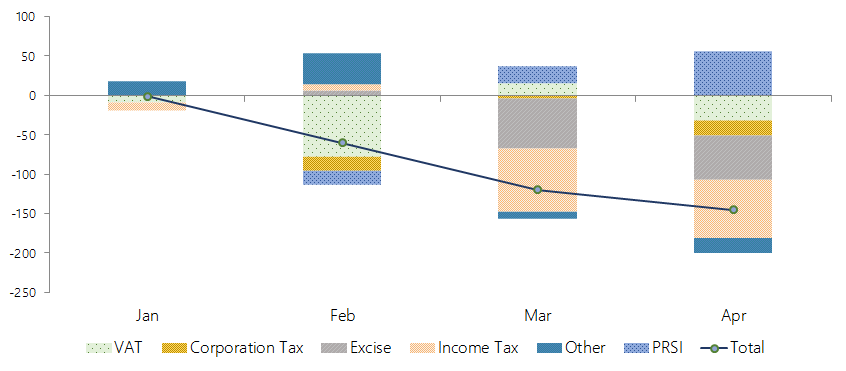

Exchequer Returns: End-April 2018 performance

€ million (cumulative), unless stated

| Outturn | Forecast | Difference | Difference (%) | |

|---|---|---|---|---|

| Exchequer Tax | 14,738 | 14,938 | -200 | -1.3 |

| ↳ Income Tax | 6,536 | 6,609 | -73 | -1.1 |

| ↳ VAT | 4,844 | 4,876 | -32 | -0.7 |

| ↳ Corporation Tax | 618 | 637 | -19 | -3.0 |

| ↳ Excise Duty | 1,661 | 1,717 | -56 | -3.3 |

| ↳ Other Taxes | 1,079 | 1,099 | -20 | -1.8 |

| PRSI Receipts | 3,488 | 3,433 | 55 | 1.6 |

| Other Revenue | 1,124 | 1,171 | -47 | -4.0 |

| Total (= Exchequer Tax + PRSI Receipts + Other Revenue) | 19,350 | 19,542 | -192 | -1.0 |

*Source: Department of Finance; and internal Fiscal Council calculations.

*Note: Other Taxes include Stamps, Capital Taxes, Motor Tax and Other Unallocated Tax Receipts. Other Revenue includes the National Training Fund, Other A-in-As, Non-Tax Revenue, and Capital Resources. PRSI and National Training Funds include their corresponding excess as indicated in the memo items.

*Source: Department of Finance; and internal Fiscal Council calculations.